Extra Disclaimer – First, we want to emphasize the speculative nature of our forecasts and these markets, in particular, with their very high level of volatility. We definitely could be wrong. Also, implementation is another risk factor. We believe the markets will continue to be very risky with huge price moves up and down for a time – making it very difficult to not lose money, unfortunately. We believe emotionally charged markets like these increase the difficulties of being successful. As always, past success, of ours or anyone else’s, does not guarantee future results. Please read all the disclaimers all over our website. Be careful and be safe.

Introduction – This blog (in reverse chronological order below) will document and discuss our forecast for the Resumption of the unfortunately very very large economic contraction. This time we will include all the previous elements of the older blogs (- Deflation Watch – Elements of Market Tops– Major Trend Changes ) (where we forecasted the 2006-2007 major Housing Bubble top and the Financial Crash bottom in 2009) into the “The Contraction Resumes” and, then into this blog, “Calling The Super All-Everything Top” for the super top that we believed peaked in late 2021/very early 2022.

Also, see our Annual Forecasts where we Forcasted the 2000 Tech Top (before we were blogging) and several of the market bottoms: Tech Wreck & Financial Crash bottom.

Please note that, as we’ve discussed before, tops are usually rounded with various indices and media discussions occurring spread out over a longer time period than bottoms where they all spike down to the low together. Also note, the size of a rebound generally indicates the period of time required for all the various areas to top; thus, a very large top takes a long time to put itself in place. For example, the 2000 equity top actually saw some indices topping back as far as 1998 and as late as late 2000; the 2006/2007 Housing Bubble (and equities) top was actually spread out over four years. With that said, this downturn will almost certainly be just as large and we think even larger, unfortunately.

The Reverse Chronological Commentary Starts Here (directly below):

__________________________________________________

11-06-2023 – Market Update – We’ve been on a roll. So, the Lower Lows we forecasted in both the Bond Market and the Equity Markets happened in Late October 2023 – on 10-27-2023 in most indices like the Dow Jones Industrials and the S&P 500. A very notable Lower Low was in the Russell 2000 on 10-22-2023 which was as low as it was back on 11-1-2020, about 3 years ago.

Of course, we haven’t been forecasting a market that is going straight down but a Series of Lower Lows and Lower Highs. And, right now, equity indices have since been rebounding sharply (which is normal in Bear Markets – see our Analysis for the Tech Wreck (2000-2003) and also for the Financial Crash (2007-2009)); and we are forecasting that, like previously, even though the current rebounds are sharp and sizeable, we are experiencing Lower Highs – notably lower than the All-time Highs around December 2021 through January 2022, documented numerous times – and lower than some other lows. In fact, we think we are at around the appropriate levels for Lower Highs to be put in right about now/here. We could have some large drops and another set of rebounds but not much above current levels – either way, then we expect we will be off to the races for new notable Lower Lows in equities. At some point, we expect an accreleration downwards in equity prices with downlegs notably longer than sharp counter-trend rebounds – This is what happened in previous Equity Bear Markets that we documented.

Bonds – Similarly, the high grade bond market; well, the yield of the U.S. Thirty Year Long Bond traded up and above 5% for the last half of October 2023 (Lower Low in prices) before the current large 20+ basis points rally (new Lower High in price). Most of the curve performed similarly except the short end which saw less movement. As before, we expect yields to now start moving back upwards notably (prices down), especially the long end of the yield curve working toward Un-Inverting the Yield Curve. Most people use the yield of 30 year Long bond to the the Two Year Treasury which is at a 4.94% but we will use the Three Month T-Bill which is at 5.44% to determine if the Yield Curve has a positive slope – that would be “more normal.” So, with the U.S. 30 Year yield currently at 4.81% (Lower High price) it has a notable way to rise in yield (down in price to a new Lower Low).

10-19-2023 – Market Update – This update is going to sound a lot like our Update from last month, except that the forecasted targets were hit but, the new forecast are essentially a continuation of the previous forecasts, all within our long term forecast framework.

Equities – Essentially all equity indices did put in new Lower Lows before rebounding a bit with the most recent new (renewed) “war” before putting in current, new choppy rebounds. Given our Long Term Outlook, we are forecasting more new Lower Lows and we believe eventually (and sooner rather than later) we will see dramatic drops in the equity indices. The leader of this category seems to be High Yield Municipal Bonds (proxy “HYD”), our old specialty! (Clark was the Portfolio Manager of “Vmpax” for 20 years ending mid-2010, which was originally in the High Yield Municipal category, until he moved it into the Short Term category). High Yield Muni proxy, “HYD,” has been dropping the most of the equity and/or equity-like indices we follow compared to previous lows. Following that category is Junk (taxable) bonds (proxy “JNK”), another of our old specialties (Clark was Portfolio of a Junk Taxable Bond fund for a concurrent 8 years). Yes, these are not equities and they do have a very large interest rate component but they are much more risky than high grade bonds – they have risky equity-like credit quality components & they seem to lead equities in the price cycles especially down from the tops. As for “pure” equities, the small caps (proxy Russell 2000, “RUT”) seems to be leading the other equity indices – it has also been heading downwards and seems to be about to break down to a new larger Lower Low. Thus, to us, the trend is down and we are expecting very large notable drops coming soon. Of course, “we will see.”

Interest Rates – As forecast, interest rates have continued to rise with the long end rising faster than the short end. We have been forecasting the reversing of the current yield curve inversion, by the long end trading off (interest rates up) more than the short end & that is what has been happening. In fact, all across the long end of the U.S. Treasury yield curve we are seeing new Record Higher High Yields (since the All-Time record lower lows a couple of years ago. The U.S. Treasury Long bond has seen its yield breach over 5% a couple of times over the past couple of days. We expect continued stair-stepping of yields of longer maturities until the curve is no longer inverted. The U.S. Treasury 3 month bill is currently at 5.42%! so the Long Bond, just to get the yield curve back to “flat” (or level), would need to rise around 42 basis points – We think a 6% Long Bond yield is very likely (and even higher after that).

Real Estate – Long term Housing Mortgage interest rates are now above 8% and we have read that “housing affordability” is the lowest since the late 1980’s – so almost 40 years. They showed a chart of it but it did not go all the way back into the 1970’s when we had the huge inflation that shot the real estate market up before it collapsed down into 1982 (the beginning of the Super Bull Market in Stocks that we think ended in late 2021 – about 3 years ago). I’ve not doubt that homes were very unaffordable at the 1979 real estate peak (that we have documented several times over the years) – we seem to be in a similar situation now.

Commodities – We are less confident on the direction of commodity prices right now, especially precious metals as they have had a bit of a breakout. However, they are largely financed and the cost of financing inventories of commodities has just gone up as we detailed above; thus, we still expect prices to tumble but are less certain.

10-16-2023 – Our Most Recent Tax-Free Performance – Similar to other recent previous months, the short term municipal bond market had another tough month but for the current twelve months, its total return rebounded because the month that dropped off had a more negative total return than the current month. As usual our performance was much more stable. So while the averages caught up a bit for the current twelve months, we are still far ahead for the longer periods.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 9-30-2023

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 2.36% | 2.68% | 4.12% | 1.94% |

| 3 Years | -0.43% | 1.75% | 2.69% | -0.95% |

| 5 Years | 0.80% | 2.04% | 3.14% | 0.89% |

| 10 Years | 0.86% | 1.95% | 3.00% | 0.97% |

| 15 Years | 1.42% | 2.25% | 3.47% | 1.73% |

| Since Inception (1/1/1995) | N/A | 3.64% | 5.60% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

9-24-2023 – Market Update – Equities – The new Lower Lows we mentioned we were looking for in our previous update arrived in essentially all equity indices we follow, with the Russell 2000 and the Dow Jones Transports leading the pack. Junk taxable bonds (proxy “JNK”) have also put in a new Lower Low and are following the High Yield Municipal Bond Market (proxy “HYD”) which seems to be leading all indices. The Housing Market (proxy “IYR”) and the Home Builders (proxy “ITB”) that we have been talking about also put in new Lower Lows. So, to us the current short term trend is downward. We expect new Larger Lower Lows shortly which would make the intermediate term be downward. If that happens we would not be surprised to see an acceleration in the downward trends.

Bonds/Interest Rates – We have recently seen all longer term U.S. Treasury yields put in Higher Highs – the 30 Year just barely and the Ten Year by quite a lot. We had talked previously about the Yield Curve Inversion and that we thought it would be resolved (to a more normal sloping yield curve with longer rates higher than shorter rates) by longer rates rising, not from shorter rates dropping. It looks to us that this breakout (upward in yields) all along the curve is the beginning of that change in yield curve shape. If this is true and long rates continue to go up (as we are forecasting), as we have discussed so many times in these pages, an ultimate impact will be declining prices of all things that are heavily financed which is pretty much everything these days. Of course, we will see.

9-17-2023 – Our Most Recent Tax-Free Performance – The short term municipal bond market, in general, had a slight negative total return for August 2023; however, for the trailing twelve months the returns improved dramatically, as a very negative month dropped off. Our performance was somewhat different with a positive total return for the month & we continued to beat the averages for the twelve months without having such a poor month drop off, because our total returns have, in general, been much more stable and positive. You can easily see how well we have done in the table below.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 8-31-2023

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 1.70% | 2.61% | 4.01% | 1.12% |

| 3 Years | -0.18% | 1.77% | 2.72% | -0.58% |

| 5 Years | 0.91% | 2.07% | 3.18% | 1.01% |

| 10 Years | 1.00% | 1.96% | 3.02% | 1.11% |

| 15 Years | 1.38% | 2.23% | 3.42% | 1.72% |

| Since Inception (1/1/1995) | N/A | 3.65% | 5.61% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

9-5-2023 – Market Update – Equities – We have new Lower Highs in most equity indices around 9-1-2023. We are looking for new Lower Lows. If we get the new Lower Lows we are expecting, then we expect the Bear Market will be resuming in force, unfortunately. The size (spread out nature) of this top has been remarkable – it has taken a long time and is so far very flat. However, we think it will be accompanied by similarly sized price drops which we believe will could be starting soon. The first step will be new Lower Lows (the initial ones of which are not that far away). Over time, the counter-trend rebounds (corrections) will be smaller and the drops will be larger; thus, the decline will accelerate. Of course, we will see.

8-15-2023 – Our Most Recent Tax-Free Performance – The short end of the Municipal Bond Market had a tough July 2023 – rates up pushing prices down and negative total returns “on average” resulting in a drop in their performance for the current twelve months. We actually, did well, picking up just a bit of performance over the periods and still putting a solid performance over all periods reported. Whether we could do this with “size” is definitely a question.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 7-31-2023

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 0.94% | 2.53% | 3.89% | 0.05% |

| 3 Years | -0.12% | 1.77% | 2.73% | -0.50% |

| 5 Years | 0.95% | 2.08% | 3.19% | 1.06% |

| 10 Years | 0.98% | 1.95% | 2.99% | 1.14% |

| 15 Years | 1.44% | 2.24% | 3.44% | 1.80% |

| Since Inception (1/1/1995) | N/A | 3.65% | 5.62% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

7-26-2023 – Market Update – Equities Still Chopping Sideways to Upward & and an Interesting Divergence – Similar to our previous Update, the markets have continued to Chop (up and down) some sideways and some even down a bit and some upwards quite lot. However, essentially all are below their All-Time Highs. The Dow Jones Industrial Average is up to only 2.38% below its All-Time High; the S&P 500 4.2% below; the NASDAQ Comp 12.2% below; the Russel 2000 18.75% below; the KWB Bank Index (“BKX”) is 39.2% below! and, the Dow Jones U.S. Total Stock Market Index is 6.4% below its All-Time High. More interest sensitive categories we track are also down – “JNK” (Junk bond) is 15.8% below its high and “HYD” (High Yield Municipal Bond) is 19.22% below its. Of course, as we have been documenting, interest rates and financing rates are up considerably over the past couple of years (from their All-Time Lows).

We note, as have others, that the rally over the past year is attributable to chiefly only five or six stocks which are reputably in the AI (Artificial Intelligence) arena. This attributable is why the narrower NASDAQ 100 is only 5.77% below its All-Time High while the broader NASDAQ COMP is 12.2% below its All-Time High. It also accounts for the very strong recent showing in the Dow Industrials and in the S&P 500, as compared to other categories without those AI stocks. Markets that shoot up with very narrow breadth like we are seeing usually are putting in major market tops – this makes sense to us in these markets.

Given the Dow Industrials is now so close to its All-Time High, we would not be surprised for it to put in a new one, while we expect most indicies will not. That would be a major “divergence” which is what is generally seen at major market tops.

Ok, the Interesting Divergence we have been following for a few months now is the differing performance of general real estate ETF’s (“IYR”) and home building ETF’s (“ITB”). IYR is 22.9% below its All-Time High while recently ITB has shot up to a New All-Time High! Wow – what a divergence. We think it will be interesting to see how this resolves.

We believe the markets that haven’t topped recently could top at any time, and soon the markets will see a resumption of their declines, including accelerations downwards in their prices. The large sizes of the divergences, in terms of price and time, to us, are indicative of how large the downturns in price and time will be. Accordingly, we think the upside is minimal and the downside is very large.

7-15-2023 – Our Most Recent Tax-Free Performance – We have continued to outperform. The general short term municipal bond category got a bit of a bounce this month and a negative month dropped off, resulting in a nice twelve month total return. We bounced too but not as much and we had a less poor month drop off but still bested the category quite nicely because we had dramatically less downside volatility last year. Looking forward, we think municipal bond yields in general continue to be far too low for the possible risk of declining tax revenues in the economic downturn that we are forecasting.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 6-30-2023

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 1.68% | 2.47% | 3.80% | 0.96% |

| 3 Years | 0.01% | 1.76% | 2.70% | -0.37% |

| 5 Years | 0.95% | 2.08% | 3.19% | 1.08% |

| 10 Years | 0.97% | 1.93% | 2.98% | 1.16% |

| 15 Years | 1.46% | 2.25% | 3.45% | 1.86% |

| Since Inception (1/1/1995) | N/A | 3.65% | 5.62% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

6-13-2023 – Market Update – A Potential Turn Back down for equities. Since the previous update on 5-14-2023 the markets have continued to Chop (up and down) mostly sideways with an upward tilt except for the NASDAQ Comp and NASDAQ 100 which have been screaming upwards. (Note: the NASDAQ was already above its early February high back in May; we didn’t mention that fact then.) Over the past month, we continued to see divergent behavior in the various indices. With some like the S&P500 rising above their early February 2023 highs and many not even close to them, like the Russell 2000 small cap index (“RUT”). The KWB NASDAQ Bank indes (“BKX”) which we highlighted last update as being in “a clear downtrend,” remains clearly so to us – far below its early February top – basically, the Current Leader.

Important to us is that THE ALL-TIME HIGHS REMAIN CLEARLY INTACT! including the NASDAQ which is still more than 15% below its 11-14-2021 All-Time Top! Also,very important to us is that most of this counter-trend rally is the result of the performances of only fewer than 10 stocks! All of those stocks are in the NASDAQ which is why the NASDAQ looks like it is in a Blow Off Top compared to the rest of the indices. They are also in the S&P500 which is why it is also above its early February 2023 high. In stark contrast, while it may not seem like it, for the vast most part, the rest of the equity market is flat to slightly down over the past several months if you don’t include the performances of those few stocks.

As for the timing of the “Resumption of the Down Durn,” at today’s close the Dow Jones Industrial Average essentially just kissed its early February 2023 high! We think this area would be a perfect place for the fairly large, but exceedingly narrow, counter-trend rally to end. Of course, we will see.

6-12-2023 – Our Most Recent Tax-Free Performance – We have continued to perform very well. The Category Average had a poor month (negative total return) and a good month dropped off the beginning of the current 12 month period. On the other hand, we had a relatively good month (positive total return) and our month that dropped off was not as good. Bottom line, the Category average lost almost 100 basis points in total return for the current twelve months versus the previous, while we lost only two basis points – the results: total return for the Category was 0.86% while we had 2.23%. Yes, the Category Average three year average annual return was reported at exactly 0.00%! while the Short Term Muni Bond Index was a -0.51% (a negative); we were 1.69% so we are pretty happy with that relative outperformance, especially over that long of a time period.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 5-31-2023

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 0.86% | 2.23% | 3.43% | 0.24% |

| 3 Years | 0.00% | 1.69% | 2.60% | -0.51% |

| 5 Years | 0.89% | 2.06% | 3.17% | 1.03% |

| 10 Years | 0.83% | 1.91% | 2.94% | 1.02% |

| 15 Years | 1.40% | 2.23% | 3.44% | 1.78% |

| Since Inception (1/1/1995) | N/A | 3.65% | 5.62% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

5-14-2023 – Market Update – Choppity Chop Chop – We are in essentially the same position as we were for our previous Market Update. Equities continue to chop mostly sideways. Some like the Dow Industrials have chopped up near their early February 2023 highs, but many have chopped downwards and are sitting just above their early March 2023 Lower Low Support; the small caps for example. However, bank stocks and bank stock indices have continued to break down and put in new Lower Lows. An example that we referenced recently (below) is the KWB Nasdaq Bank Index (“BKX”), which includes 24 banking stocks representing the large U.S. national money centers, regional banks and thrift institutions – it is in a clear downtrend. To us the bank stocks are the leader for stocks in this cycle currently. We expect essentially all equities and equity indices to be putting in Lower Lows and to be in very obvious downtrends shortly, unfortunately.

Commodities are in positions similar to our last Update but with Gold performing like the Dow Industrials, rising even through its early February 2023 highs but with oil chopping down towards its early March 2023 lows. We still expect both financial and industrial commodities to drop along with stocks; however, as previously, we are less certain upon whether they will put in the dramatically “Lower Lows” we are expecting for stocks.

Interest Rates – Mostly chopping up and down BUT, the Yield on the One Month U.S. T-Bill just shot up dramatically from 4.33% on 4-20-2023 up to 5.52%! – that is a rise of 119 basis points. The yield curve now has its largest inversion of this cycle, at least from the One Month out to The Five Year which is now at 3.45% (the 30 Year is at a 3.80%). So, our forecast for rising rates resuming seems to be coming true. As we have said before, we believe the Inverted Yield Curve will be resolved mostly by long rates rising rather than by shorter rates falling. Of course, as we have discussed previously, if longer term interest rates go up, prices of bonds and whatever they are financing (which is almost every thing these days) will see related price drops, including stocks, bonds, commodities and Real Estate.

5-14-2023 – Our Most Recent Tax-Free Performance – The Category Average had a big bounce back for the month of April 2023; however, our return is still a good amount higher for the current twelvel months. A more accurate performance guage is probably the longer time periods; needless to say, we are pretty happy with our absolute and relative performances. Interestingly, at this time, we feel general high quality municipal bonds are far too rich versus similar duration U.S. Treasuries. This situation has been going on for about a year but with the recent spike up in short Treasury Yields, we feel the muni market is really due for a correction of sorts. Also, given our forecast for lower quality assets and the economy in general, you can imagine we think that municipal tax revenues could take a big hit. Thus, we are very negative on lower quality and even fairly high quality municipal bonds from a credit quality perspective. Also, we think essentially all municipal bonds are over priced currently and we would not be surprised to see a large sell off across the curve and across all credit qualties. Of course, we will see.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 4-30-2023

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 1.85% | 2.21% | 3.40% | N/A% |

| 3 Years | 0.54% | 1.86% | 2.85% | N/A% |

| 5 Years | 1.05% | 2.07% | 3.18% | N/A% |

| 10 Years | 0.82% | 1.90% | 2.92% | N/A% |

| 15 Years | 1.44% | 2.26% | 3.48% | N/A% |

| Since Inception (1/1/1995) | N/A | 3.66% | 5.63% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

4-16-2023 – Market Update – Our market forecast remains intact. Stock indices have continued to chop mostly sideways with some like the Dow Industrials (and Bitcoin) chopping upwards but with others like the Russell 2000 (small cap stocks) chopping downwards. Importantly, all the previous “lower highs” are still intact! This includes not only the equity indices we follow but the equity-like indices we follow (junk taxable bonds and high yield municipal bonds) and Bitcoin. It has taken longer than we thought it would but we think our forecast is still going to be accurate in terms of prices. And, we believe that the longer it has taken for the next decline to start, the more likely the decline will also be that much longer and larger, unfortunately. Accordingly, we are still forecasting large across-the-board, headline-grabbing equity price declines soon, unfortunately.

Commodities – On the other hand, industrial and financial commodities have put in new “lower highs.” But we still expect commodities to turn down along with equities; however, we are less certain upon whether they will put in the dramatically “lower lows” we are expecting for stocks.

Interest Rates – We expect the rise in interest rates to resume (or has just resumed) with “higher highs” for interest rates. If this forecast is correct; higher interest rates will very likely push down prices of other assets, which goes along with our general asset prices forecast.

Real Estate – Generally sales volumes dry up before price declines. And, that is exactly what we are seeing with real estate. To us it has to do with the “Bond Math” we have explained several times previously. For example, someone with a $1 million house financed at 4% can’t sell it and buy anther $1 million house financed at 6% at the same monthly payment because the interest rate is higher. In order for the monthly payment to be the same, the purhase price has to be lower. The basic formula is: interest rates up = prices down. Now, using “Bond Math” we do not think we have seen nearly a large enough fall in the prices of real estate for the amount of the rise in interest rates & that is why the sales volumes have been drying up. Thus, they can’t buy so they can’t sell. In fact, they aren’t even listing them for sale; for sale listings have dropped. So, sales volumes have dropped as forecast; next, to us should be much larger price drops, unfornately. But, if you can buy cheaper, then you can sell cheaper – the problem is the financing rate – the interst rate – interest raes up = prices down. To us, prices have not dropped nearly enough yet.

4-14-2023 – Our Most Recent Tax-Free Performance – Short term bond markets rebounded in March 2023 after a rough February 2023. The better March 2023 combined with a rough month dropping off of the calculation resulted in much improved one year total returns for the current twelve months. Thus, the category average made up some ground but their improvement from a negative total return to a positive for the year versus our much more stable outperformance highlights our very strong risk-adjusted performane – a larger return with lower volatility – which is what we are striving for – top risk-adjusted performance; and you can see it has paid off for us over the longer periods!

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 3-31-2023

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 1.07% | 2.25% | 3.46% | 1.52% |

| 3 Years | 0.52% | 1.89% | 2.90% | 0.53% |

| 5 Years | 1.05% | 2.09% | 3.22% | 1.30% |

| 10 Years | 0.87% | 1.91% | 2.94% | 1.14% |

| 15 Years | 1.46% | 2.28% | 3.51% | 1.87% |

| Since Inception (1/1/1995) | N/A | 3.66% | 5.64% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

3-19-2023 – Our Most Recent Tax-Free Performance – The general, high-quality bond markets had a rather rough month for February 2023. Yes, we did very well with a slight positive total return for the current month which brought our nationally tax-free total return for the one year to +1.69%, which compares very well to the -1.18% (yup that is a negative) for the Category Average for the current year. You can see we also did exceptionally well for the current three years while both the Category Average and the Index put in negative total returns, for the that period. Phew – it has been rough out there in the bond markets over the past couple of years (as we have documented in our Market Commentaries, below) and our knowledge and diligence (and the fact that we are managing a small amount of money compared to the mutual fund we managed for 20 years) has definitely paid off!

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 2-28-2023

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | -1.18% | 1.69% | 2.60% | -1.75% |

| 3 Years | -0.35% | 1.78% | 2.74% | -0.43% |

| 5 Years | 0.83% | 2.04% | 3.14% | 0.97% |

| 10 Years | 0.75% | 1.88% | 2.89% | 0.99% |

| 15 Years | 1.46% | 2.24% | 3.44% | 1.66% |

| Since Inception (1/1/1995) | N/A | 3.66% | 5.63% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

3-16-2023 Market Comment – More on Banking and Silicon Valley Bank (Parent “SIVB”) implosion’s effect on the economy. Here is a comment posted today on AOL (Yahoo News) from the President of a bank that we think is very telling:

“When you have banks like us pulling back from lending because we’re concerned about our ability to raise enough liquidity to weather whatever storm may come, even though we’re sitting in a very good spot today with almost 50% liquidity. That’s a crisis, in my opinion,” Martin said.

His response to the liquidity problems at Silicon Valley bank and Signature Bank (“SBNY”), etc. is likely typical and we think appropriate – in order to raise liquidity for potential cash withdrawls by depositors, he is going to make fewer loans and raise cash levels. To us, this action is “Contractionary;” in fact, the already-here liquity issues indicate the economy is already contracting (which we already knew, see below). Because most banks are going to take this action, the result will be less lending which will result in an additional “slow down” in the economy, which, with two negative quarters of GDP, was already slowing down. Also, because the banks are going to compete less to make loans (make fewer loans), lenders will likely have to pay higher interest rates. So, the liquidity issue will likely result in interest rates going up more. In addition, the Federal bailout of depositors over the $250,000 insurance limit is to be funded by increased insurance fees paid for by bank depositors; thus, pushing up those costs. Again, we think that will be “Contractionary,” unfortunately.

Accordingly, we still believe what we said on 2-19-2023 (below): “Importantly, we are expecting very large price drops out of the current choppy corrective sideways moves. We think these moves (if they happen) will be large enough to capture the general public’s attention.” We believe, as we indicated in our 3-13-2023 Market Comment, that as more market indices break below their December 2022 lows, we will see an acceleration in price declines resulting in price drops that are quite notable.

We note that West Texas Intermediate crude OIL just dropped in price below its December 2022 price low on 3-14-2023; thus, re-inforcing our forecasts. Of course, this is an Industrial Commodity. Prices of Financial Commodities like Gold have been rising recently; however, we expect they will resume their fall, possibly in response to the contracting economy and also rising interest rates (as most of their ownership is financed).

Interest Rates – Interest rates on the highest quality longer bonds have dropped along with the current events; however, we expect they will start rising again soon. Interest rates of lower quality bonds should rise even more (and faster) as the economy continues to weaken and lenders (and junk bond owners) become more concerned about being paid back and want to be compensated more (with higher interest rates); thus, we expect “credit quality yield spreads” will continue to widen. We are watching prices of several Junk taxable Bond ETF’s and a couple High Yield Tax-Free Municipal Bond ETF’s – they have all been declining in price (interest rates up) and are hovering above their December 2022 lows. Once, these lows are breached, we would not be surprised to see their prices drop precipitously.

Of course, this is our Opinion and “we will see.”

3-13-2023 – Market Comment – Did The Next Drop in Equity Prices Start? – Yes, we think so. We have been patiently waiting for the next drop to start, and it most likely has. We have been watching the market indices relative to their December 2022 bottoms (looking for new “lower lows”). Most equity indices have distinct price bottoms in December 2022; some less distictive than others, but, we have been waiting for those lows to be broken; thus, putting in “lower lows” which to us, confirms the downtrends have resumed. Right now only a few have put in the “lower lows” we have been looking for – for “confirmation” of the resumption of the downturns but all of them have been heading downwards in price for some time now.

Importantly, the Dow Jones Industrial Average passed below its December 2022 bottom slightly on 2-28-2023, bounced back above it and then dropped substantially below it on 3-10-2023, the same day Silicon Valley Bank (“SIVB”-NASDAQ) was taken over by the Feds. Importantly, on Monday 3-13-2023 the Dow Industrials continued downward by another 90 or so points.

The KWB Nasdaq Bank Index (“BKX”) includes 24 banking stocks representing the large U.S. national money centers, regional banks and thrift institutions. The KWB Index also has a December low on 12-19-2022 (same day as the Dow Industrials and several other equity indices). It passed below its December 2022 low on 3-9-2023 (so a bit behind the Dow Industrials); and more so on 3-10-2023, the day Silicon Valley Bank was taken over. Today (3-13-2023, the next trading day), the KWB indice fell another 11.66%!; it now is pretty far below its December 2022 low – definitely a “lower low” and, to us, this is confirmtion that it has resumed its downtrend. Of course, after such a drop and so much publicity a choppy partial rebound is likely, but to us the trend in price is down.

Most other equity indices we watch have been heading down to their December 2020 lows but are not below them (yet). The most notable is that of the Russell 2000 which probably had risen the furthest above its December 2022 price low (the Dow Industrials probably had the smallest rise); The Russell 2000’s price has been heading down hard over the past week and is very close to a “lower low.” The couple of Junk Bond indices we follow have dropped down and have been hovering on their December 2022 lows for a while as have the few High Yield Municipal Bond Indices we follow. We really wanted breaks of the December 2022 price lows (putting in “lower lows”) by more indices before reporting it but then the Banks got hammered (we note: a few days after the Dow Industrials has already broken its December low (per above) so we decided to point it out now.

Will the Silicon Valley Bank depositor bailouts for those over the $250,000 insurance limit stop the price declines we are forecasting? No, we do not think so. In fact, the bank’s problem is an indication that goes along with our forecast. As we have pointed out so many times previously, when interest rates rise, very often “financial things break;” that is probably what is happening now.

2-19-2023 – Market Comment – Chopity Chopity Chopity Chop – Prices of most asset cagegories have continued to Chop – short up and down movements – with little to no upward progress since late November 2022. Importantly, the way we see it, they are all essentially still in downtrends – in an sideways/upward correction, still heading downwards from their All-Time Tops. Financial commodities like Gold have rallied more as has BitCoin but we think they are still ultimately in larger downtrends. It seems most markets are moving together similarly to during the Housing Bubble top (2006-2007) and subsequent Financial Crash (down in to 2009-2012). Those moves then were opposite of the U.S. Dollar and we would not be surprised that the financial markets are now in a similar situation. Time will tell. Importantly, we are expecting very large price drops out of the current choppy corrective sideways moves. We think these moves (if they happen) will be large enough to capture the general public’s attention.

2-16-2023 – Our Most Recent Tax-Free Performance – The current twelve month performance of short term bond market, in general, bounced back significantly partly due to a solid bounce in prices (drop in yield) in January 2023 but mostly because of a drop off of the January 2022 performance which was very negative for normal bonds. You can see we are still doing very well and, we have done it with much less volatility, which is often used as a measure of risk; thus, we feel we’ve hit our target of superior risk-adjusted performance (as well as superior absolute performance).

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 1-31-2023

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | -0.45% | 1.61% | 2.48% | -0.42% |

| 3 Years | 0.07% | 1.80% | 2.77% | 0.19% |

| 5 Years | 1.02% | 2.06% | 3.18% | 1.30% |

| 10 Years | 0.68% | 1.89% | 2.90% | 1.18% |

| 15 Years | 1.42% | 2.27% | 3.49% | 1.87% |

| Since Inception (1/1/1995) | N/A | 3.67% | 5.64% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

1-17-2023 – Our Most Recent Tax-Free Performance – You can see from the following chart that we did exceedingly well in an exceedingly tough year for the bond market. Essentially, all bond categories lost money in 2023, even the short term categories – even the short term Tax-Free Municipal Bond categories; but we had a +1.36% nationally tax-free return! It was exceedingly tough to achieve that kind of performance in that market. With perfect hindsight, we could have been even more disciplined but it was very difficult to find the bonds we wanted. At times we ended up with fairly high percentages of cash – we just could not find what we wanted and, at those times, the market ended up trading off, which worked to our advantage. In perfect hindsight, we could have done better without certain purchases at the recent market tops; still, given how everyone else did, we’ll take our performance! And, you can see, it bolstered our long term performance too!

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 12-31-2022

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | -2.68% | 1.36% | 2.09% | -3.39% |

| 3 Years | -0.10% | 1.71% | 2.63% | -0.04% |

| 5 Years | 0.78% | 2.03% | 3.13% | 1.05% |

| 10 Years | 0.79% | 1.87% | 2.87% | 1.06% |

| 15 Years | 1.43% | 2.25% | 3.46% | 1.92% |

| Since Inception (1/1/1995) | N/A | 3.67% | 5.64% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

12-19-2022 Market Comment – Equities & Commodities & Cyber”Currencies”– We have just seen “Lower Highs” and “Lower Lows” in essentially all major equity indices including real estate (EFT “IYR”) on a daily basis. Also Junk taxable Bonds (“JNK”) and High Yield tax-free Municipal Bonds (EFT “HYD”) on an hourly basis. And, commodities West Texas Intermediate Crude Oil and Silver but Gold with only a “Lower High” so far. Bitcoin (BTCUSD) made it all the way up to over 21,000 but, fell sharply back down to below 16,000 before rebounding a bit to under 17,000 currently. We have been looking for the next large downtrends in prices of risky assets and it seem they are here (even for low risk assets). We wouldn’t be surprised to see quick drops back down to the Lows of late September/early October 2022; then maybe a choppy rebound and then off to the next set of drops. It could be a rise in rates (see next Section) could be the trigger as most assets are highly leveraged with debt financing.

Interest Rates – Interest rates at the long end of the curve have risen enough (to us) that the trend in yields at the long end of the curve is upwards again. We would not be surprised for the short end of the Yield Curve to follow along with the long end’s rate rise. The Yield Curve is still well inverted but we are looking for that inversion to end from longer rates going up more rather than from short rates dropping. Of course, we will see.

12-18-2022 – Our Most Recent Tax-Free Performance – We’ve continued to perform well. The averages bounced back a bit so they are quite a bit less negative for the current twelve months. We also bounced back a bit but were already positive for the period. Now that interest rates at the short end of the Yield Curve are pretty high, any increases in yield (decreases in bond prices) should be cushioned more by the high current income than when yields were starting from such low levels. This is also true for longer maturities except the the Yield Curve is inverted; we believe the Yield Curve Inversion will turn back to “normal” (short rates lower than longer rates) mostly by yields of longer bonds rising than yields of shorter bonds dropping. Of course, we will see.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 11-30-2022

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | -2.89% | 1.42% | 2.19% | -3.52% |

| 3 Years | -0.11% | 1.74% | 2.68% | -0.03% |

| 5 Years | 0.78% | 2.05% | 3.15% | 1.06% |

| 10 Years | 0.72% | 1.87% | 2.87% | 1.03% |

| 15 Years | 1.45% | 2.27% | 3.50% | 1.95% |

| Since Inception (1/1/1995) | N/A | 3.67% | 5.65% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

11-28-2022 Market Comment – Equities –Well, we got the Bitcoin drop (see previous Market Comment) but equities have not yet joined in with gusto; however, (see Data below) it looks to us like some of the equity rebounds have ended with various retracement percentage rallies of previous drops and new tops of varying dates with the Dow dropping the least, rebounding the most, and putting in the most recent peak (with other equity indices putting in recent peaks days to even weeks previous). All other equity indices we looked at follow this pattern (see below). Most people watch The Dow Industrials but there is a lot more going on. The Dow Industrials have held up far better than all the other equity indices we have looked at but give a less accurate view of the markets at this juncture – to us, things are weaker than the Dow Industrials look.

Here is the data on the most recent cycle: The Dow Jones Industrials dropped about 16% from its 8-16-2022 peak down to its 9-30-2022 bottom; since then it has rebounded retracing just over 100% of that drop to Friday 11-25-2022, and dropped a bit below that 8-16-2022 peak by today’s close. The Dow Jones Transports dropped about 21% from its 8-16-2022 peak down to its 9-26-202 bottom; since then it retraced about 2/3rds of that drop to a top on 11-15-2022 from which it has dropped by a bit over 3%. The Wilshire 5000 dropped by about 17% from its 8-16-2022 peak down to its 9-26-202 bottom; since then it retraced about half of that drop to a top on 11-25-2022 from which it has dropped by a bit over 1.5%. The NASDAQ dropped about 21% from its 8-15-2022 peak down to its 10-14-202 bottom; since then it retraced about 25% of that drop to a top on 11-15-2022 from which it has dropped by a bit about 2.7%. The same pattern exists for the Russel 2000 (small caps) and Junk Bonds, High Yield Municipal bonds and Real Estate (ETF “IYR”) that we have been following – with retracements of about 50% or less of their corresponding previous drops. We do believe these will all be “in sync” during the next large asset price drops, which we think are due at any time.

Back to Bitcoin – Since its last big drop (see previous Market Update), Bitcoin (“BTCUSD”) has been moving along a new shelf around 16,250. We expect it to break down notably from that shelf.

Oil – From its 5-1-2022 top, Oil (WTI) has dropped by 32.5% to its current low today (11-28-2022) at $77.21 – Its previous low was at $20.48 on 1-1-2020. For now, we expect oil’s price to drop along with equities and other asset prices, probably at least down to around $50.

11-18-2022 Our Most Recent Tax-Free Performance – We’ve continued to keep our large lead. Again, yes that is a -4.14% for the current twelve months by the Category Average, -5.35% for the corresponding Muni Bond Index (compared to our +1.20%). Quite amazing but yields of “normal bonds” went up a lot from very low levels as we forecasted and documented in these pages, causing the large negative total returns for typical bonds. And those are “Averages” – the mutual funds in the catagory that had the longest durations (a measure of interest rate risk, similar to maturity length) were down much more – I see one that was down 7.41% (-7.41%) for the current twelve months. “Live by the Sword, Die by the Sword” – those taking them most interest rate risk did the best when rates were dropping and now gave it all back during the rate rise. Our very short durations, including very large coupons and also being heavily in cash right at the worst part of the market (i.e. lowest yields) because we just couldn’t find anything we liked at those levels (as we documented below), helped us put in a very good relative performance. Basically, our method of “Focusing on the Upside Potential and Downside Protection & Current Yield” methodology worked rather well. (To be fair, it is highly unlikely we could have put forth our incredible relative performance managing the billion dollar, plus mutual fund I managed for 20 years ending July 2010 – it was very difficult for us over the past few years, to find bonds we liked even for our private accounts.)

Looking forward, recently we have had much better success finding & purchaing bonds that we like (even if we think they are somewhat over priced). The market sell off has created much better opportunities than we have seen for years. We expect continued dissarray in the bond markets to present opportunites for our clients.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 10-31-2022

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | -4.14% | 1.20% | 1.85% | -5.35% |

| 3 Years | -0.57% | 1.71% | 2.63% | -0.60% |

| 5 Years | 0.37% | 1.99% | 3.07% | 0.48% |

| 10 Years | 0.60% | 1.84% | 2.84% | 0.85% |

| 15 Years | 1.40% | 2.27% | 3.50% | 1.87% |

| Since Inception (1/1/1995) | N/A | 3.67% | 5.65% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

11-09-2022 Market Update – We have been looking for the current choppy counter-trend partial-retracement rebounds in prices of stocks, “cryptocurrencies,” commodities and other assets to “top out” and for drops to take out previous All-Time Lows since their All-time Highs (largely in late 2021 or early 2022, see previous updates). Panic – we were and are still looking for some panic by the holders of at least some of those assets. Last time, we said

We note that, in the current downtrend, we have yet to see any panic in those bond markets nor the stock market yet but, if our forecast is correct, we expect we will see that kind of emotion and accompanying price action. Of course, we will see.

Well, today Bitcoin (BTCUSD), which had been chopping sideways from months, finally dropped below its 6-18-2022 low – it had lagged almost all other indices in doing so but now appears to us to be The Leader in the next part of the down draft. Over the last week it fell, to today, by about 27% to be about 11% below its June low. That is the largest move on the chart since June 2022 and most of the drop was today. It is now at its Lowest Low since its All-Time High. The Fundamental news was that world’s second-largest crypto exchange, FTX, was “suddenly” in trouble and then filed for bankruptcy. Apparently, investors in it will or have lost several billion dollars. We are not experts in this credit but, because of its size and the asset category, we would expect large ripples could rock other areas (prices) of “finance.”

Also, we think it is important When the various asset classes have had their most recent peaks – are they turning downward? BTCUSD’s most recent peak was back on 8-13-2022; thus, yes it has turned downward. The Dow Jones Industrials’ most recent peak was yesterday on 11-8-2022 – so it really hasn’t turned down much. We also note that the Dow Industrials have rebounded the most from their recent low (9-30-2022) of most asset classes. Also having its recent peak on 11-08-2022 are the Dow Transports. Other assets that have earlier peaks and that we think have already turned downward are the Russel 2000 (Small Caps) on 11-1-2022; the S&P 500, Wilshire 5000, Dow Utilities, Real Estate (“IYR” ETF proxy), and Junk Taxable Bonds (ETF “JNK” proxy) on 10-28-2022; the NASDAQ Comp and the NDQ (100) on 10-25-2022. Note: NASDAQ is on the verge of putting in a new lower low – so in that way it is one of the leaders of this down draft. Also, we note that most of those indices put in current lower lows on around 10-10-2022 and then had rebounds to those peaks (above); however, the high yield municipal bond tax-free funds (“HYD,” “SHYTX,” “HYMB”) we are tracking already put in lower lows and seem to be ahead in the “stair stepping” downward; however, they do have the aspect of declining credit quality and the huge rise in interest rates (this year) since they are bond funds.

The bottom line, for us, is that Bitcoin has just met our forecast by putting in new Lower Lows in a pretty precipitous drop and we expect the rest of the equity type assets will join very shortly. As outlined previously, “the drops should be striking enough to be reported in the regular media.” As for high quality bonds, their prices have dropped a huge amount (interest rates up) and we expect a “breather” rally shortly (interest rates down a bit) before the trend in falling prices/rising interest rates resumes (per our previous Update Comments).

10-27-2022 Market Update – The markets have continued to chop upward longer in pretty typical bear market rallies with some retracing more of the previous drops than others. The biggest rebounder has been the Dow Jones Industrials followed by the Russell 2000, then the S&P 5000 with the higher beta NASDAQ bringing up the rear, which could be telling. Also, the more interest-rate sensitive equity-like indices, which often lead stocks, have rebounded even less – the Dow Utilities and Junk Taxable Bonds (ETF “JNK”) – and High Yield Municipal Bonds (ETFs “HYD” “SHYTX” and “HYMB”) have continued downward! which also might be telling. Real Estate ETF “IYR” has chopped mostly sideways with somewhat of a rebound but more than Bitcoin. The amount of time and rebound of prices is more than adequate for a typical bear market rally, so we expect a resumption of the downtrend we have been detailing at any time. If/when so, prices should very quickly take out recent prior lows into All-Time Lows since the All-Time Highs in late 2021 and/or 2022 (see previous posts for details) and then plummet further – the drops should be striking enough to be reported in the regular media.

U.S Treasury Interest Rates have continued to rise which will put more pressure of prices of most assets as most are fairly heavily financed. The highest part of the curve right now is the 6 Month U.S. T-Bill at 4.52% – One year ago it was at almost 0.0% – so that is a huge increase that will ultimately be reflected in lower asset prices. For now, it looks like the rise in interest rates will likely take a “breather” (break); at least, yields of U.S. Treasuries, the safest. It may be that as stocks go down sharply, money flows into the Treasury Market. In that case, money will not likely flow into Junk Taxable bonds nor High Yield Munis, in fact, all bonds except U.S. Treasuries could experience notable sell offs to raise money for margin calls and due to credit quality concerns. That is the scenario that we saw in 2008 when we were managing the Billion Dollar Evergreen Strategic Municipal Bond Fund (“VMPYX” “VMPAX”) through The Financial Crash. We note that, in the current downtrend, we have yet to see any panic in those bond markets nor the stock market yet but, if our forecast is correct, we expect we will see that kind of emotion and accompanying price action. Of course, we will see.

10-13-2022 Our Most Recent Tax-Free Performance – You can see from the table, below, that we have continued to outperform the Short Muni Mutual Fund average – now, incredibly by over 500 basis points for the current twelve months ending 9-30-2022; and, by lesser (but still large) annual percentages over all other periods reported. Importantly, these performances at this point in time (just after a huge drop in bond prices, in general) very well illustrate how superior risk-adjusted performance adds value. At market tops it is much more difficult to understand and explain this concept. But right now, you can see that, for the current one year we had a +1.01% total return and the category average was -4.15%. The key is that not only did we outperform but we did it with less volatility and less downside risk. At market tops the benefit is not nearly as obvious because some will say, “well, we would have taken more risk to get a higher return.” It is easy to say that “after the fact” when “after the fact” is after a rally rather than after a price collapse.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 9-30-2022

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | -4.15% | 1.01% | 1.55% | -5.46% |

| 3 Years | -0.48% | 1.72% | 2.64% | -0.44% |

| 5 Years | 0.37% | 1.97% | 3.04% | 0.48% |

| 10 Years | 0.62% | 1.84% | 2.83% | 0.85% |

| 15 Years | 1.42% | 2.28% | 3.51% | 1.90% |

| Since Inception (1/1/1995) | N/A | 3.67% | 5.65% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

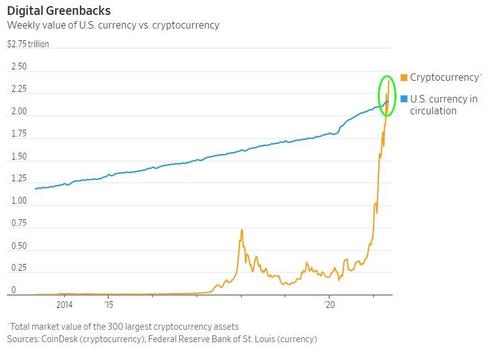

10-10-2022 – Extra – Here is a nice table (compiled by someone else) that we have named, “Drops from their Tops,” that gives more information to what we have been forecasting and documenting:

It shows their peaks and percentage drops until about now (they didn’t put the ending date).

10-9-2022 – Market Update – Most equity indices took out (went below) their June 2022 lows as forecast; thus, putting in their Lowest Lows since their All-Time Highs (typically in late 2021 or the first week of 2022). We also said, that those that had already fallen below their June 2022 lows would likely fall further as the laggers reached their June 2022 lows and this happened too. For example, the Dow Industrials fell, from then, by another almost 3% below its June 2022 low. Maybe importantly, this drop brought the Dow Industrials “Drop from The Top” (its All-Time-High, daily close, on 1-4-2022) to 21.9%; thus, putting it in a Bear Market (a 20% decline or more is generally defined as being in Bear Market). That was a low and we had a pretty big bounce the following couple of days before a similarly large drop. Most Equity Indices performed similarly. One that “outperformed” to the downside is the Dow Jones Transports; down almost 30% from its All-Time High in late 2021.

One that put in its All-Time High late but is now “a leader” is the Dow Jones Utility Index, which is more sensitive to interest rates than most equities. It is down “only” 19.4% from its All-Time high on 4-20-2022 (closing basis) but, it took out its recent low so it is at its Lowest Low since its All-Time high; in that way The Utility stocks are a leader of this cycle. Note, with respect to the Dow Theory, all three – Industrials, Transports and Utilities – are in alignment in the downward direction.

Another “Leader” of this cycle is another category that is more sensitive to interest rates, somewhat similar to Utilities but has fallen more. The iShares U.S. Real Estate ETF (“IYR”) also took out its June 2022 lows and also is below its recent low of 9-30-2022 and is now down 32% from its All-Time top on 12-30-2021 (closing prices). Importantly, the price drop in this category in the equity market has yet to be recognized in the residential real estate market.

The chart above shows the U.S. 30 year mortgage rate has risen substantially from under 3% in early 2021 to over 7% currently with a “near-vertical” rise. The mathematics is that, in order to have the same monthly payment financed at 7% versus 3%, the amount one could borrow is substantially lower. That drop in borrowing has yet to be reflected in prices of residential real estate.

The chart above shows the U.S. 30 year mortgage rate has risen substantially from under 3% in early 2021 to over 7% currently with a “near-vertical” rise. The mathematics is that, in order to have the same monthly payment financed at 7% versus 3%, the amount one could borrow is substantially lower. That drop in borrowing has yet to be reflected in prices of residential real estate.

Also note in the Chart that the U.S. 30 year mortgage rate started down at a top in early 2000, right when we had the Technology Stock Top; then it dropped right along with the “Tech Wreck” into the 2003/2004 low. Next, it rose with the Housing Bubble (and stock market) before dropping right along with the “Financial Crash” (in most asset prices except the U.S. Dollar) down into lows of 2009 to 2012 (depending upon the asset class). At that point, the fairly high positive correlation ended. And, starting from its All-Time low in early 2021, we think it has a highly negative correlation with asset prices; thus, the spectacularly steep (“near-vertical”) rise in the U.S. 30 year mortgage rate is slightly leading the drops in prices of stocks and real estate, etc.

Gold and Silver have been dropping in price but not as much as the stock market. The situation is similar with Precious Metals Mining Stocks (“GDX” ETF). We are not experts in these Companies; however, we have been reading that the price increases in fuels that the mining companies use could overwhelm a rising precious metals market and combine for worse effects in a declining precious metals market. The cost of financing – both business and inventories by companies and individual holders/owners is another important issue – most is financed so the rising cost of interest could, or could be, take/taking a toll. In this cycle neither precious metals nor mining stocks worked as an inflation hedge (some day they probably will again). If interest rates continue upwards as we are forecasting, and we are in a deflation, as we are forecasting, precious metals and mining could continue to be under pressure. If, in addition to that, we have prices of fuel rising (even while in a deflation) because of supply constrictions, precious metal assets could take a big price tumble. Thus, we think this area is also very speculative.

Also, we note that Bitcoin‘s price has continued to chop sideways in a fairly narrow channel (if you look at a longer term chart). We still believe its price will plunge downwards out of this choppy sideways channel.

Looking forward, we expect further price drops in most asset classes. The next target is the “Pre-Covid Tops” in February 2020 and after that the “Covid Lows” a month later in March 2020 (remember that drop!). With respect to these targets, we are in a similar situation to what we just went through. For example, the Dow Industrial Average is already (just barely) below its “Pre-Covid Top.” However, the S&P 500 is over 7% above its “Pre-Covid Top.” In this area the Dow Utility Average is a Leader – down almost 10% below its “Pre-Covid Top.” Another one right at its “Pre-Covid Top is the Russel 2000 Small Cap Index. Interestingly, Junk Bonds (“JNK” ETF) never really got above its “Pre-Covid Top” – it got up to it but essentially not above it and is now only 2.8% above its “Covid Low” – this is only using prices and not including the interest/dividends that it receives and pays; however, the category has proven itself over many cycles to be a leader of equity prices and likely so this time too. “GDX” (mining stocks) is below its “Pre-Covid High” but over 28% above its “Covid Low.” Bitcoin has a long way to go down to its “Pre-Covid High” and its “Covid Low” -it is still 263% above its “Covid Low!” You can see there is a lot of variability in where the prices of various asset classes are relative to these two targets; however, in downturns there is usually a convergence in prices and returns and we would expect this to be the case if our forecast proves to be correct. We think the next downlegs will be significant, unfortunately.

9-25-2022 – Market Update – On our last update on 9-5-2022 we said,

…we are looking for the downtrends in the prices of most assets to accelerate soon; we expect prices will drop quickly to their various previous levels of around June of earlier this year, and then likely take another “breather” before resuming their downtrends once again. However, given how precarious everything is, we expect surprises to be to the downside and they could be large.

The next day the markets drifted a bit lower but over the next few days the Dow Industrials rose sharply by almost 4%; however, in a HUGE one day drop, the markets gave it all back. Continuing downwards, from that top through last Friday the Dow Industrials dropped a total of 8.16% and took out (dropped below) its June low as we forecasted. Interestingly, with similar market actions, several indices took out their June lows; however, some have not. For example the S&P 500 is still 0.7% above its corresponding June 2022 low. Some indices have broken down through further than others. The Dow Industrials is 1% below its June 2022 low but, the Dow Transports dropped to 6% below its June 2022 low. We believe all major equity indices that haven’t, will soon take out their June 2022 lows. If that happens, those that are already below them will most likely drop even more; thus, we are expecting the “surprises to be to the downside” as we alluded to previously.

Other types of indices also broke down through their June 2022 lows – Junk Bonds (ETF “JNK) fell to 1.7% below its June 2022 low. High Yield Municipal Bonds (ETF “HYD”) fell to 1% below. Bitcoin (“BTCUSD”) followed a similar, if not more volatile pattern. It went down the first day, then shot up by 13% over the next three days, and then dropped to 4.3% below where it was on 9-5-2022; however, it is still above its June low by 6.5% – still, we are expecting a large drop that will take it below its June 2022 lows. If you look at the long term chart, even though these percentage moves are rather large, overall, the move since June 2022 is just a long, choppy sideways move (which we think it will break down out of in notable fashion along with the other markets).

Real Estate (EFT “IYR”) also broke down below its June 2022 low by 1.3%

Commodities performed somewhat similarly. The Commodities Research Board (CRB) fell to 0.85% below its JULY 2022 low. Gold has fallen to 2.9% below its July 2022 low. Oil did not have a June nor July 2022 low but has fallen, in a persistent choppy fashion, almost 35% from its June 2022 high.

The point we want to make here is that most of these indices and categories have put in new lows or are close to doing so. The only “investment” that is rising is the U.S. Dollar, which has been continuing to breakout to higher highs. This situation is very similar to the Financial Crash (2007 – 2010) down from the Housing Bubble Top (2005-2007) where the U.S. Dollar went up and essentially everything else went down.

Bonds/Interest Rates – The other thing that has gone up to new highs is Interest Rates. (Remember interest rates up = bond prices down.) We have had all kinds of activity in the U.S. Treasury Market. While the 30 Year and the 10 Year Treasury yields have broken out to significant new highs (3.61% and 3.69%, respectively), their yields are still lower than those of the short end of the Treasury Interest Rate Yield Curve, which have shot up even more! It is quite amazing (and reflects inflation expectations) that the highest yield yielding Treasury is the Three Year Note at 4.32%! Also above 4% are the Two Year Note and the One Year T-Bill. The Six Month T-Bill is at 3.91%, so also above the yields of the 10 year and the 30 year U.S. Treasury yields!

Looking forward from here, we expect the major trends in most asset prices to be downward. However, given how persistent some of the drops have been (Treasury Bond and Note prices) we wouldn’t be surprised to see some categories break from the rest. However, while we expect that while that may be true, in hindsight, if you look at the long term price graphs, they will still trend together as bonds and stocks have in most longer term cycles.

And, as previously, “we expect surprises to be to the downside and they could be large.”

Also note, that we expect overall inflation to subside and turn into deflation as declining asset prices and rising interest rates result in defaulting companies and securities, pushing up unemployment, etc. Unfortunately, people and businesses and governments and municipalities will have to cut back, thus, resulting in falling prices overall. However, unfortunately, some prices where scarcities have been created, could continue to rise as shortages in those areas develop – darn.

9-18-2022 Our Most Recent Investment Performance – The bond market including municipal bonds had another tough month (and year). You can see we did very well versus the competition; however, we were a bit disappointed that our one year total return was only 1.13% (tax-free) but, still, our performance was over 400 basis points better than the Morningstar Short Term Muni category average for the period.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 8-31-2022

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | -3.27% | 1.13% | 1.73% | -3.94% |

| 3 Years | -0.14% | 1.81% | 2.78% | -0.01% |

| 5 Years | 0.63% | 2.00% | 3.08% | 0.78% |

| 10 Years | 0.81% | 1.84% | 2.83% | 1.05% |

| 15 Years | 1.57% | 2.31% | 3.55% | 2.07% |

| Since Inception (1/1/1995) | N/A | 3.68% | 5.67% | N/A |