First, we want to emphasize the speculative nature of our forecasts and these markets, in particular, with their very high level of volatility. We definitely could be wrong. Also, implementation is another risk factor. We believe the markets will continue to be very risky with huge price moves up and down for a time – making it very difficult to not lose money, unfortunately. We believe emotionally charged markets like these increase the difficulties of being successful. As always, past success, of ours or anyone else’s, does not guarantee future results. Please read all the disclaimers all over our website. Be careful and be safe.

Second, please look at the long term oil price graph above. Note its all-time top way back in 2008. Also note, how it resumed its downturn from 2011 to 2014 and again in 2018. People generally are not aware that the big cycles peaked way back in 2008; even back as far as 1999 if prices are adjusted for inflation.

Introduction – This blog (in reverse chronological order below) will document and discuss our forecast for the Resumption of the unfortunately very very large economic contraction. This time we will include all the previous elements of the older blogs (- Deflation Watch – Elements of Market Tops– Major Trend Changes ) (where we forecasted the 2006-2007 major top and the Financial Crash bottom in 2009) into this single blog: “The Contraction Resumes” for the next super top.

As from the 2000 top (see our Annual Forecasts) and the 2006-2007 top, we believe “The Contraction” will be evident in all sorts of areas. Of course, it will be reflected in declining prices of assets (like commodities, equities and real estate) and in increasing yields, especially of lower quality bonds. We believe it will also be evidenced in increasing levels of discord in all sorts of areas – we are using such examples as a confirmation of the resumption of the contraction. Unfortunately, we’ve begun to see a lot of signs of discontentment, not only abroad but now in the United States.

Please note that, as we’ve discussed before, tops are usually rounded with various indices and media discussions occurring spread out over a longer time period than bottoms where they all spike down to the low together. For example, the Commodities (CRB index) peaked April 2008 with a lower (20% lower) secondary peak in April 2011 – these tops have not been eclipsed, while certainly many other indicies have had new rebound highs since then. Also note, the size of a rebound generally indicates the period of time required for all the various areas to top; thus, a very large top takes a long time to put itself in place. For example, the 2000 equity top actually saw some indices topping back as far as 1998 and as late as late 2000; the 2006/2007 equity top was actually spread out over four years. With that said, this downturn will almost certainly be just as large and we think even larger, unfortunately.

Taxable Junk bonds (as measured by Bloomberg Barclays High Yield Bond ETF (“JNK”)) also have a highest ever peak (December 2007) before the Financial Crash that has not been eclipsed. Its rebound peak since the 2009 Financial Crash bottom is July 2014. Since then it put in a spike low in February 2016. From there it rebounded to a lower high August 2017 and has been heading down from there ahead of the pack in the current down cycle. To be fair, a large portion of the taxable junk bond market is related to oil, which trended along behind the CRB index, as detailed above. Oil had its highest peak in June 2008 at $161, with its crash bottom January 2009 at $50, and a lower rebound high at $127 April 2011; then crashing down to $36 January 2016 before putting in a lower high of $74 June 2018 and heading down, also ahead of the pack, from there.

Similarly, the KBW Bank Index (“BKX”), representing national money center banks and leading regional institutions, had its highest ever peak in May 2007 (before the Financial Crash) that has not been eclipsed, barely. After dropping by over 84% to a low in February 2009 at the Financial Crash bottom, it rebounded to a double top – both times just barely below its 2007 all time top – on 1-21-2018 and 3-4-2018 with a dip in between. From there it dropped 29% down to a low on 12-16-2018 before rebounding to a lower high on 1-20-2019. Note, this index, in many ways has led the trend of the rest of the equity markets since 2007.

Another example for this cycle’s top is the high grade bond market (remember interest rates up = prices down so the top is when interest rates start rising). The tops of the various maturities are spread out over several years (from 2012 to 2016) – see the next few paragraphs.

Yields on the Freddie Mac 30 year Mortgage bonds bottomed late 2012 (its bond market top). (Its yield shot up pretty high in 2013 but it fell again to a higher low in 2016, which is why it didn’t hurt the real estate market that much; however, from 2016 it stair-stepped upwards, passing its 2013 yield top in mid 2018, to a new high in yields, which did start to take a toll on real estate.)

The One Month T-Bill yield bottomed at essentially zero in 2014 and started to rise in late 2015 (its market top). The Three Month T-Bill similarly saw its yield bottom in late 2015 (its market top), as also did the One Year T-Note.

The Five Year T-Note yield bottomed in mid 2016 (its bond market top). Similarly with the U.S. Ten Year T-Note and the U.S. Thirty Year T-Bond (Long Bond) and the Bond Buyer Municipal Bond Index – it also had its price top in mid 2016.

((***Note that these U.S. Treasury yield bottoms were taken out in early 2020 during a flight to quality from the general market crash.***))

Please note: most people will have no idea that this huge cycle started topping so early – 2008 for commodities & oil and taxable junk bonds (and lower rebound peaks of 2011, 2011, and 2014, respectively) and 2012 for high grade bonds, because more popularly followed stocks and real estate topped years later. Also, note, if adjusted for inflation peaks began in 1998 and 1999 depending upon the category.

__________________________________________________

The Reverse Chronological Commentary Starts, Here Below:

5-14-2021

From our most recent call for The Top of The Mania on 5-10-2021 after several private cyber currencies puked around 40%, big capitalizatin stocks (S&P 500, Dow Jones Industrials, etc.) dropped about 4% last week, before percentage rebound retracements that are typical in a BEAR MARKET. We continue to note (as detailed below) that several equity and equity-like indices including junk taxable bonds and the small cap stocks peaked a month or two ago. Even the NASDAQ peaked back a bit ago on 4-26-21 before the large cryptocurrency drop. We also note that the cryptocurrencies that dropped also experienced fairly large percentage rebound retracements typical of a BEAR MARKET. Still we want to see some more lower lows before we say “the top is definitely in.”

5-14-2021

Below is our recent performance. We have continued to lag in the current one year period because we are holding fairly high levels of cash as it has been very difficult for us to purchase bonds of the downside protection and current yield we are seeking at this point in various investment cycles (that we detail in these pages). We expect that we will outperform going forward. While we believe we have done exeptionally well for the risk taken over the recent shorter year periods, in addition to that, our five year and longer performance far outperforms on an “absolute basis” and even more on a “risk-adjusted basis.”

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 4-30-2021

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 3.69% | 1.74% | 2.68% | 3.60% |

| 3 Years | 2.44% | 2.33% | 3.58% | 2.99% |

| 5 Years | 1.60% | 2.16% | 3.32% | 1.87% |

| 10 Years | 1.62% | 1.99% | 3.07% | 1.81% |

| 15 Years | 2.11% | 2.55% | 3.93% | 2.68% |

| Since Inception (1/1/1995) | N/A | 3.81% | 5.86% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

5-10-2021 “Top of the Mania To You!?!”

Dogecoin USD – Peaked Saturday 5-8-2021, after hours at $0.7387 and collapsed to $0.4245 on early Sunday morning (5-9-2021) before rebounding to $0.5783 a day later on Monday, 5-10-2021. So it fell 42.5% over two days, then rebounded by 36.2%.

Ethereum (Grayscale Ethereum Classic Trust) – Peaked late Thursday 5-6-201 at $95 then plummented to $53.55 on 5-7-2021, Friday Morning. Then rebounded to $64.20 mid-day Monday 5-10-2021 but closed down at $47.55. So this one fell 43.6% over one day and then rebounded 20% the next trading day before its next drop which made the total “Drop from The Top” – down 50%! Wow – that is some action for a “currency!”

Was that the top of this Mania? Very well could be. But, even with those huge drops we do not yet have a lower low. Still, it could be the parabolic rises have been broken. Of course, we will see. Short or Long or on the sidelines, be careful out there! We believe the volatility we are seeing in these private cryptocurrencies could quickly spread over to other markets given the all the information we have documented over the years.

5-9-2021

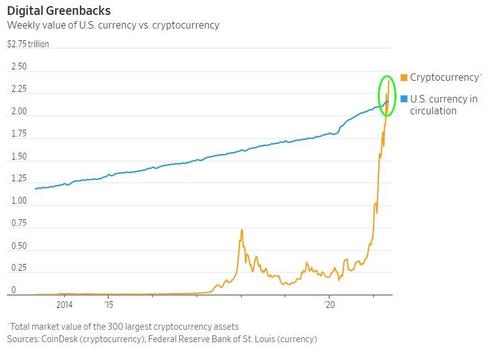

We have read that “Cryptocurrencies crossed a key threshold in the last week, surpassing the value of all physical US dollars in circulation…“ And, here is the graph:

4-25-2021

Market Mania – S&P 500 and Dow Jones Industrial Averages put in slight new highs; however, other indices peaked back in Mid March 2021, including the small caps, Russell 2000, S&P 600 Small Cap Index, etc. Other indices that typically peak before the major stock market indices including junk bonds (“JNK”) and high yield municipal bonds (“HYD”) peaked in Mid February 2021. In addition, Bitcoin fell 15%, a week ago last Sunday (4-18-2021); todady (4-25-2021) it (BTCUSD) is at $47,934, down 24% from its $63,381 all time top on 3-15-2021. Also, Dogecoin (another private block chain “currency” – hmmm, there is no limit to the supply of these private “currencies” as there are no barriers to entry, currently) which had risen 18,000% from around a year ago (not that difficult to get such huge percentage when you start at essentially zero) has dropped about 40% since 4-19-2021 – in over just six days! (Note: we are not an expert on these coin securities as they are brand new and may or may not be reported correctly nor correlate with the underling “currency”- but we think what we have reported is accurate.)

Given the incredible action in the Block Chain based currencies including their huge percentage-increase parabolic rises that we documented above and have documented previously, we believe we – not just the U.S., but most of the world World, is in a HUGE MANIA even bigger than 1630’s Tulip Mania when a single Tulip bulb sold for more than a house before dramatically collapsing in prices in February 1637. – At least you can plant a tulip bulb. Confirmation of the Mania is that it seems to exist in other areas of society besides private “currencies” – We seem to be in very crazy times.

Given the recent, large drops in prices of Bitcoin and Dogecoin (detailed above), it appears to us that their large, near vertical parabolic rises have just been broken. If this is correct, expect the fall in their prices to continue all the way down to “true value” (remember, there are no barriers to entry with private block chain currencies (government currencies are a different matter)). The size of this market of private (non-government) block chain “currencies” or “E-coins” is now huge, in part because there are so many but, mostly, because their prices have gone up so much (“on the margin” – remember, when there is a trade at a price, all of that coins of that issue (Bitcoin, Doge or whatever) are valued at that same price).

We just found a webside: https://coinmarketcap.com/all/views/all/ that lists over 400 “E-coins,” their market capitalizations, etc. We do not know if their data is reliable. They give the market cap of Bitcoin at $893,435,303,805 – wow – that is huge! That is the largest one – but, there are at least 400 more smaller ones listed. Thus, there is plenty of “money” (or however you want to categorize it – say “wealth” or, probably more accurately, “perceived wealth”) to evaporate (even faster than it was created) and, then, to implode other markets in a huge ripple, unfortunately.

We believe this Mania has spilled over into other markets. It is kind of the euphoria that we’ve seen at other markets tops (the 2000 Tech Top, the 2006-2007 Housing Bubble Top, etc.) but on steroids. Valuation separates from reality, enhanced by a “suspension of disbelief” by enough market participants (enthusiasts) to dramatically overcome the skeptics, for a while – sometimes a long while. It is typically reflected the most in one market – usually the one with the shortest track record & the least understanding – like private block chain currencies! (or tulip bulbs, or electric companies when they were brand new). When it cracks, likely all other markets that were overvalued (in a mania or in bubbles) will follow along with it, down to notable bottoms. Unfortunately, that scenario fits with most of all the information and opinion we have published in these pages.

4-11-2021

Interest rates of shorter municipal bonds dropped (prices rose) and a poor performing month dropped off the current twelve month performance, resulting in a large total return for the category for the current twelve months ending 3-31-2021. Our performance lagged the current twelve months as we held substantial amounts of cash as we were unable to buy the defensive bonds we were seeking and we had outperformed during the month that dropped off. However, as you can see in the chart we continue to outperform for all longer periods, especially when adjusted for risk.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 3-31-2021

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 3.06% | 1.81% | 2.78% | 3.50% |

| 3 Years | 2.26% | 2.36% | 3.63% | 2.81% |

| 5 Years | 1.56% | 2.16% | 3.32% | 1.88% |

| 10 Years | 1.61% | 2.00% | 3.08% | 1.84% |

| 15 Years | 2.07% | 2.56% | 3.94% | 2.67% |

| Since Inception (1/1/1995) | N/A | 3.82% | 5.87% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

3-10-2021

Interest rates increased the speed of their rise last month as we discussed in our 2-26-2021 Commentary, below. Accordingly, our performance increased its lead over the Morningstar Short Muncipal Bond Fund category Average over most periods as shown in the table below. Note our increase was principally due to having less interest rate risk.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 2-28-2021

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 1.16% | 1.99% | 3.07% | 1.80% |

| 3 Years | 2.18% | 2.41% | 3.71% | 2.69% |

| 5 Years | 1.51% | 2.17% | 3.34% | 1.77% |

| 10 Years | 1.61% | 2.03% | 3.12% | 1.85% |

| 15 Years | 2.05% | 2.61% | 4.02% | 2.64% |

| Since Inception (1/1/1995) | N/A | 3.83% | 5.89% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

2-26-2021

Interest rates rose since our last report, as we expected. The yield on the U.S. Thirty Year rose notably from 1.91% on 2-10-21 by 39 basis points up to a 2.30% on 2-25-201 – that is a 20% rise in yields! The Ten Year all the way down to the Three Year rose similarly. And, the markets finally took note, probably, in addition to the size of the move, because prices (prices down when yields go up) dropped to sitting on “critical support” according to the technical types; thus, most of them are very nervous now, which, makes it likely we will get a bit of a rebound in prices (down in yield) before the main trend (up in yields) resumes.

That sharp rise in yields is attributed to causing the Dow Jones Industrial to drop about 1,000 points – given the huge level it dropped from, the amount of the drop, and the form of the drop (among other factors), we can make the case that the top is “in;” however, given how irrational the markets are – at such high levels when the economy had dropped so much, “don’t bet the ranch.” Still, given the continuing trend in interest rates in such a highly leveraged enviornment, we think it is highly probable that the top is here (somewhere, if not just passed).

Bitcoin also rose to put in a “Notable High” (see our 2021 Annual Forecast) of around $59,000 on 2-21-2020 before dropping down to around $45,000 on 2-26-2021 – a drop of almost 24% in just a few days! (how is that volatility for a “currency”!?). This drop also attributed to the recent rise in interest rates (which will probably be just a blip, although the start of the ramp up in yields (down in prices), in the long term scheme of things).

Inflation and gold. Many are expecting a large to huge inflation and even runaway inflation because of their speculations about increases in the money supply and also increased fiscal stimulus. However, price action in gold (and sliver) we have been forecasting is giving a different signal. Also attributed to the recent rise in interest rates, the price of gold continued its decline (that started on 8-6-2020 at $2,069) from $1,842 on 2-20-2021 down $114 to $1,728 on 2-26-2021 – that recent continuation is a drop of over 6%. So there is a difference of opinion on future inflation between the gold market and what many pundits are saying. We expect debt to default quicker than money is printed and bailouts are passed. This situation would be similar to that of the Financial Crash (2006 down into 2009) but likley larger from higher levels – both prices and debt levels, unfortunately.

2-12-2021

Here is our current performance. Please note we have been postured very conservatively with respect to rising interest rates and declining credit quality.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 1-31-2021

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 1.99% | 2.06% | 3.17% | 2.54% |

| 3 Years | 2.32% | 2.41% | 3.70% | 2.83% |

| 5 Years | 1.64% | 2.16% | 3.33% | 1.92% |

| 10 Years | 1.71% | 2.04% | 3.13% | 1.92% |

| 15 Years | 2.10% | 2.64% | 4.07% | 2.67% |

| Since Inception (1/1/1995) | N/A | 3.83% | 5.89% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

2-12-2021

Markets have continued in their choppy ever so slightly rising upward slants at incredibly high valuation levels, even in the face of the incredibly increased RISKS of these times in addition to all the stuff we have documented over the last few years. They have even rebounded enough to erase the huge drop into March 2020 related to the Corona Virus, etc. Even with record levels of debt climbing ever higher in almost all issuing categories. Mortgage payments and rent payments being further furloughed making the current debts ultimately even higher & higher, for example. The lack of rationality in the markets is appalling but, you can sell at those prices — there are buyers.

I can (and have in these pages) document all kinds of fundamentals that show vast over-valuation in essentially all investment categories. However, in markets this irrational that knowledge does not help much, at least not in the short term (or, in the case of the last several years, the intermediate term). We think we are in one Overall Super Bubble. Given regular “Fundamental Analysis” and even our Upside Potential/Downside Protection(/Current Yield) analysis and investment style doesn’t really help a lot right here, other than to be very conservatively postured – as we say at times, “Give up some upside potential to pick up a more than proportionate amount of downside protection” & we usually continue “& current yield” but right now the yields are so low. However, we have other methods of looking at these markets.

Interest Rates – Interest rates have continued to chop up to new rebound highs. The U.S. 30 Year yield which had an All-Time yield bottom on 3-9-2020 at 1.02% moved up to 1.88% on 1-11-2021. Even though still an absolute low interest rate (1.88%), that rise is almost 90%! The U.S. 10 Year is in a similar configuration. It put in its All-Time low yield on 8-4-20 at 0.508%. It chopped up to its rebound yield high of 1.145% on 1-11-2021, a rise of 125%. Again, a considerable rise but still at an absolute low yield level. Still, these yield rises have dropped the corresponding bond prices notably. The recent yield rises almost look like breakouts, to the upside. If (and when) yields shoot up more, it will take a toll on pretty much all asset prices as in this Super Bubble, pretty much all assets are heavily leveraged, unfortunately.

Importantly, The Dow Jones Industrial Average put in a new, ever so slight, All-Time Market top on Thursday 1-14-2021. Other indices had either peaked earlier and/or did not quite put in new All-time Market tops but they are all close if not there. But, Importantly, the next day, on Friday, we see the possible beginning of “The Decline from the Tops.” Every Equity indice that we looked at has that appearance to us – that of starting significant potential declines (some starting before 1-14-2021). We believe these declines could be the start of something big, even huge. We also have a huge, steep parabolic rise in BitCoin (and other E-coins); however, it looks like that steep parabolic rise has been broken (either way, we think this is a casino market – not “investing,” and certainly not “currency” or “money” at least not at this juncture). Of course, we will see but that very well could be the end of this incredible move up in asset prices from the Financial Crash lows (2009 to 20012, depending upon the category).

1-17-2021

Although we have continued to do very well on a longer term basis, both in absolute terms (below) and on a risk-adjusted basis (since the risk we think we are taking is very low), we have lagged a bit on for the current one year absolute performance (see chart below) as we have been upwards of 40% in cash over the last several months because we have not been able to purchase the extra safe bonds we want at the prices we are bidding. However, for the longer periods you can see we easily beat the index and that is even with a much lower risk profile.

Over the past 31 years of professionally managing 4 mutual funds in three different bond fund categories and these private accounts since 1995, we have often had difficulties staying invested near market tops, especially, if we are trying to position in what turns out to be the best way. So, with our extra conservative posture right now, we would not be surprised to see a turn up in rates and an increase in concern for lower quality credits.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 12-31-2020

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 2.27% | 1.99% | 3.07% | 2.96% |

| 3 Years | 2.21% | 2.40% | 3.70% | 2.80% |

| 5 Years | 1.67% | 2.17% | 3.34% | 2.00% |

| 10 Years | 1.66% | 2.03% | 3.13% | 1.90% |

| 15 Years | 2.10% | 2.65% | 4.08% | 2.67% |

| Since Inception (1/1/1995) | N/A | 3.84% | 5.90% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

12-21-2020

The net for most asset prices from last month was a lot of choppy, slightly upwards price movements, some to ALL-TIME Highs but not by much, a few days ago.

Today was the Winter Solstice (shortest day of the year) and, also, quite possibly much more importantly, the tightest conjunction of Jupiter and Saturn in around 796 years but, this time, the first in modern history in Aquarius. Jupiter and Saturn moved into Aquarius staggered a few days ago.

Stocks put in a small top a few days ago. Obviously, all our concerns about lack of downside protection and huge amounts of downside potential are as strong as ever and even stronger given new All-Time Highs in some indices. We would not be surprised to see a noteable acceleration down in price in stocks and bonds (up in yields), especially lower quality and longer term bonds. Yup that is speculative; however, at these levels, our opinion is that peope are not “investing,” they are “speculating,” likely wildly. Of course, we will see.

11-15-2020

As we forecasted last month, we did experience quite a lot of fireworks in the markets just before and after the election. As some things still are not resolved, we are expecting more fireworks to come.

Just after the election, some stocks and indices broke upward very sharply but then turned around and, before the close, plummeted in notable partial retracements of their rises. At this time some of those sharp inter-day peaks have not been eclipsed; however, over the past few days some of the indices have run up yet again to new All-Time Highs! Numerous inter-market divergences continue to indicate a huge topping process in progress as we’ve talked about too many times. Thus, we are still waiting for some remaining Final All-time Highs & it could be a while; however, when it happens, at this point, we believe the turn down will be swift and notable. Given all the data we’ve gone over so many times before, we believe the upside is severely limited while the downside potential is huge, unfortunately.

Gold – As stocks were shooting up in their temporary ascent, gold dropped almost $100 per ounce – a huge move and, importantly, has not rebounded notably since that drop. This drop makes the trend of gold downward more likely. It also put a hole in most “Inflation Theories.” Silver has performed similarly.

Bonds – Interest rates of the most intermediate U.S. Government Treasuries have continued to drift upwards, putting in higher highs and lower lows of yields. In fact, they’ve gone up enough, in most cases, to be declared “breakouts,” although, slight. As we have reviewed numerous times, we expect that the All-Time lows in interest rates are in our past. We expect the rises in interest rates to begin to accelerate. If and when they do, those with high debt levels, which includes most everyone these days, from individuals to companies to municipalities, etc. will very likely be in trouble as their debt service loads increase while asset values fall, unfortunately.

Credit Quailty & Yield Spreads – The effects of the shutdowns of the economy are continuing with many unfortunte consquences likely to surface more strongly. There will likely be huge negative consequences for landlords, renters, mortgagees & mortgagors and tax payment recipients that will result in defaults, unfortunately. This situation should first result in credit quality yield spreads blowing out from their ridiculously tight levels to probably, eventually, record wide levels given how widespread these problems are, unfortnately. Then, the official defaults. However, in the Financial Crash (2007-2009) we often saw downgrades from Investment Grade directly to default with no intermediate downgrade steps by the rating agencies. So far, almost the entire market has held up so, at this time, we expect a shockingly swift turn of events, unfortunately.

11-15-2020

We are continuing to do well compared to the pack even with the very high levels of cash we have been carrying and the market not going down substantially (yet). We continue to have difficulty finding the bonds that we want at the prices we would like to purchase at. Still, look how well we have continued to perform! When or if the market trades off, whether just due to rising interest rates (or credit quality yield spreads blowing out, as we expect they will), we think we will definitely outperform as we usually do in more hostile environments.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 10-31-2020

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 1.98% | 1.99% | 3.05% | 2.90% |

| 3 Years | 1.88% | 2.44% | 3.75% | 2.37% |

| 5 Years | 1.55% | 2.18% | 3.35% | 1.85% |

| 10 Years | 1.77% | 1.98% | 3.04% | 1.77% |

| 15 Years | 2.09% | 2.68% | 4.13% | 2.66% |

| Since Inception (1/1/1995) | N/A | 3.85% | 5.93% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

10-18-2020

The 9-2-2020 equity market tops that we speculated would be “All-Time”…”for those that hadn’t already topped (up to years ago)” during the Great Divergence have held for essentially all indices and most stocks. There have also been a lot of shorter term divergences above recent highs, but not “All-Time Highs,” for several indices that saw there “All-Time Highs” months to years before the 9-2-2020 “All-Time Highs” of other indices. The S&P 600 Small Cap Index as compared to the Dow Jones Industrial Average, for example.

Interest rates – Nothing much as changed since our previous updates. The previous All-Time Lows of the U.S. Treasury 10 year and 30 year are still intact with rates drifting slightly upwards with slightly higher highs and lower lows. Shorter term rates have been scraping sideways, somewhat above their lows, of May or July 2020 depending upon the duration.

We have “The Election” coming up, which could be accompanied by some wild market fireworks. Of course, we will see.

10-14-2020

We are still doing well in the short run (One Year Performance); although we have dropped a bit. We have been having a difficult time buying what we are seeking, and, accordingly, have been carrying much higher levels of cash. Thus, our risk downside risk level is even lower than normal. Of course, if rates rise, the extra defensive posture will help us outperform in a negative market even more than normal, we do believe.

Over the long run we continue look very good – Have a look at the table below.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 9-30-2020

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 2.19% | 2.09% | 3.21% | 3.53% |

| 3 Years | 1.91% | 2.44% | 3.75% | 2.42% |

| 5 Years | 1.59% | 2.19% | 3.37% | 1.93% |

| 10 Years | 1.46% | 1.98% | 3.05% | 1.80% |

| 15 Years | 2.08% | 2.71% | 4.15% | 2.67% |

| Since Inception (1/1/1995) | N/A | 3.86% | 5.94% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

9-20-2020

The likely Final Tops of the equities and indices that hadn’t already topped (over the past several years, as we have outlined, below), that we speculated would occur soon, likely happened on 9-2-2020. On 8-27-2020 we “speculate[d] that we [were] directly in the neighborhood of ‘The Equity Market Top’ (at least for those stocks and indicies at or near All-Time Highs)”…that hadn’t already topped.

Since 9-2-2020 we’ve seen fairly large drops in almost all equities and, importantly, of those few Indicies and equities that posted their All-Time-Highs (see 8-27-2020, below). Since those initial drops, we’ve seen a choppy sideways rebound shelf constructed. We believe prices will drop through that shelf. If they do, then we will have a set of lower lows and that will make this “call of the top” more solid. Next, we would need a lower high to confirm the trend is down. However, if the drops are very large, as we believe they could be, we believe “the tops will be in.”

Interest Rates – Since our last Market Comment, interest rates of the U.S. 10 and 30 year Treasuries have drifted up, leaving our previous comments (about an imminent rise in interest rates) intact.

Of course, we will see.

8-27-2020

Tippity Tippity Top(s)? Based on the analysis below we are going to go out on a limb and speculate that we are directly in the neighborhood of “The Equity Market Top” (at least for those stocks and indices at or near All-Time-Highs). If this is so, prices of essentially all assets will be falling along with them.

In our last update we were talking about major divergences. We want to add two major divergences versus the current All-Time-Highs in the NASDAQ and the S&P500 (that happened today).

One is the stock prices of the U.S. banks. We have talked many times over the years about the KBW Bank Index. However, we were asleep at the switch this time; but we have it now. The KBW Bank Index put in its All-Time-High in June 2018 followed by a sizeable drop into December 2018. From there it had a choppy rally to its next (lower) peak in December 2019, followed by another sizeable drop to late March 2020 (with the rest of the market). From there it has rebounded to a lower peak at the end of May 2020 (thus it has a series of lower lows and lower highs from its All-Time-Top) and started dropping down again (while the NASDAQ and the S&P 500 were/are putting in new All-Time-Highs).

Another equity investment category with a major divergence (however not over as long a time period) are the Utility stocks. Note that utilities are affected some what by the bond market (like bank stocks talked about above). The Dow Jones Utility Index’s spiked up to its All-Time-High on 2-18-2020, followed by a major drop down into mid/late March 2020. Since then it put in a couple of lower highs the highest (and also the most recent ) was on 6-8-2020, and another one almost as high on 8-10-2020 (again, a series of lower lows and lower highs since its All-Time-High) – since then it is down while the NASDAQ and S&P 500 put in there latest All-Time-Highs.

Yields (interest rates) breaking up – over the past two days Yields of most U.S. Treasuries have broken up above their previous highs. We have been trying to call the bottom of interest rates for quite a while. We note that the yield of the U.S. Treasury 30 year’s All-Time-Bottom was on 3-9-2020 at 1.02%!!!! (wow is that low); the Treasury 10 year’s All-Time-Low was later, just a few weeks ago on 8-6-2020 at only 0.54%. However, for us besides these extremely low levels, since those lows higher highs have given way to new higher highs. So, for us, the trend in yields is upwards. This is the case almost entirely across the U.S. Treasury yield curve. Importantly, because the yields are so low, it won’t take but small basis point rise in these yields to really push down bond prices. And, as we’ve pointed out so many times over the years, almost all assets these days are heavily financed from real estate to stocks to commodities. So if we do have a large (relative) rise in interest rates, that should push down asset pries. Unfortunately, downside potential from the lofty asset price levels is substantial even with a somewhat small rise in interest rates (because they are so incredibly low to start with).

August 16, 2020

Market Comment – The huge market Divergences that we have been writing about (and that essentially always accompany major market tops) are continuing (but a couple may have already morphed into a “change of trend”).

A great example is oil which we talk about at the top of this page. Below is the long term graph. While its current price is $42.01 (not reflected in the chart), the important concept is that its price is far far below its all time high back in 2008 and is below many highs since then, including the most recent one at the beginning of 2020 as shown in the chart. Its trend is clearly down over numerous long and intermediate time periods:

At the same time, we have a Record high in the NASDAQ, near record high in essentially all bond categories (interest rates down, bond prices up) including Treasuries, Corporates, High Yield Junk bonds, and Municipal bonds. Besides the huge divergences in the price of oil versus these other categories, we also have large divergences within those categories. Stocks for example, had the all time high in the NASDAQ but the small caps are lagging and are noticeably below their all-time highs.

At the same time, we have a Record high in the NASDAQ, near record high in essentially all bond categories (interest rates down, bond prices up) including Treasuries, Corporates, High Yield Junk bonds, and Municipal bonds. Besides the huge divergences in the price of oil versus these other categories, we also have large divergences within those categories. Stocks for example, had the all time high in the NASDAQ but the small caps are lagging and are noticeably below their all-time highs.

Another major divergence within those markets is that while some equity indices are at record highs, essentially all stocks are not. How can this be? It is because this last drive up has been essentially driven by less than 8 stocks (as we outlined previously). So another major divergence is between those “special” stocks and the rest of the equity market. Astounding, but typical at major market tops!

Another major divergence from the price of oil is the price of another commodity, gold, which just eked out a new all-time high. Yet another major divergence related to that is the price of gold versus the price of silver, which is far below its all-time high.

(An Aside: Interestingly, everyone (well, most everyone) is obsessed with inflation due to the actions of the Federal Reserve (a subject we reviewed in more detail previously); however, major commodities, oil and silver, have prices substantially or noticeably below new highs. Also, interest rates are near record lows. Back when inflation was raging in the late 1970’s, you may remember, interest rates were around 17% not 1.71% like the U.S. Treasury Long Bond is currently. Of course, we make this point, in part, because it helps our case that we are going to experience a definite deflation. In addition, as we have discussed numerous times in these pages, we expect interest rates to shoot up, pushing prices of all heavily financed assets (which is essentially all assets) downwards substantially. While we have been searching for the bottom in interest rates for some time, it may be that we just passed it a week ago for the U.S. Ten Year Treasury yield and over five months ago for the U.S. Thirty Year Treasury yield – another divergence! and a possilbe “change in trend.”)

The divergence of gold prices versus silver prices is probably an excellent “real time” example because it has likely been followed by a change in trends! Not only did their fortunes diverge, with gold just eking out a new all-time new high and silver not being close to its all-time high (although both heading up strongly), but, importantly, they both just experienced substantial price drops. So, this may be an good example (if the new trend continues) of how a major divergence (one at a record high but not true for another similar category) turns into a “change in trend;” in this case downward; thus, marking a significant top. We expect to eventually see this behavior in all market categories.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 7-31-2020

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 2.14% | 2.27% | 3.49% | 3.15% |

| 3 Years | 1.92% | 2.44% | 3.76% | 2.41% |

| 5 Years | 1.61% | 2.18% | 3.36% | 2.00% |

| 10 Years | 1.50% | 1.98% | 3.05% | 1.80% |

| 15 Years | 2.11% | 2.71% | 4.18% | 2.69% |

| Since Inception (1/1/1995) | N/A | 3.87% | 5.96% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

July 20, 2020

Market Comment – Although it may not feel like it (as we will explain below), almost all stocks and stock indices continue to trade below their June 8, 2020 highs (or earlier in the case of the small cap stocks and small cap indicies like the Russell 2000 and S&P 600 Small Cap Index). The reason why is that the NASDAQ Composite and the NASDAQ 100 have zoomed back up to New All-Time Highs – and that is what the media attends to. In fact, almost all the up volume and price action is in just 7 stocks. I’m sure you’ve heard of them – we’ve highlighted most of them before: Apple, Google (Alphabet), Microsoft, Netflix, Amazon, Facebook and Tesla. A subset of these are called the FAANG stocks. We have also characterized the Bubble these stocks have caused the “E-Commmerce Bubble” which we think is more useful than the “All Everything Bubble” which some analysts call our current predicament.

The key is the huge divergence between the early All-time Toppers (small caps, etc.) and the Later Toppers (Dow Jones Industrial Average and the S&P500, etc.) and the E-Commerce Bubblers (NASDAQ, more specifically the seven stocks we mentioned above) is very typical behavior of a major market top – as we have explained so many times before – back at the 2000 top before the “Tech Wreck,” back at the Housing Bubble Top before the “Financial Crash” into 2009/2010, and now (well, over the past couple of years). Accordingly, all our previous forecasts stand. Also, importantly, we don’t think it is just stocks putting in a major top, but also Bonds – geeze, in many ways the Bond top is even more spectacular, which, unfortunately, means their crash (interest rates zooming up) will also be spectacular. We also believe commodities will resume their bear markets.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 6-30-2020

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 1.95% | 2.36% | 3.62% | 3.11% |

| 3 Years | 1.82% | 2.46% | 3.79% | 2.36% |

| 5 Years | 1.52% | 2.19% | 3.36% | 1.96% |

| 10 Years | 1.51% | 2.02% | 3.11% | 1.83% |

| 15 Years | 2.05% | 2.72% | 4.18% | 2.63% |

| Since Inception (1/1/1995) | N/A | 3.88% | 5.97% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

June 14, 2020

Market Comment – We note the decline in stocks we forecasted on June 8th 2020 (in these pages) has very likely begun. Last week we had one day where the Dow Jones Industrials was down Nealy 7%. If this trend continues and we think it will, we expect a replay of the huge declines experienced earlier in the year in all the same categories but this time we think the drops will, unfortunately, be larger. Of course, we will see – nothing is certain in “investing” or “speculating” which is what most of it is when your are at such extremely high price levels (and low yields) and with such huge amounts of debt financing pretty much everything. We ask, what could go wrong? Be careful out there – which likely means, take some risk off the table.

Our short term Municipal Bond Account Performance – We are still doing well, because we never dropped much in price. However, you can see the M.S. Short Category rebounded quite a lot but did not entirely recoup their earlier losses. The index really rebounded because it is at the full duration for the category. Importantly, even though the risk of default in municipal bonds has gone through the roof because of the Corona Lockdowns, municipal bonds are, after this months huge rebound, trading as if there has been no increase in default risk. In light of the huge increase in likely defaults in the municipal bond market, we ask, where are the municipal bond rating downgrades? Where is the huge increase in credit quality yield spreads? (in fact, the opposite happened during May 2020 – credit quality yield spread tightened up dramatically from the earlier widening). All we can say is, hold on to your hats if you have much credit risk or duratin risk in the municipal bond market.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 5-31-2020

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 1.88% | 2.43% | 3.74% | 3.39% |

| 3 Years | 1.66% | 2.47% | 3.80% | 2.19% |

| 5 Years | 1.44% | 2.18% | 3.36% | 1.96% |

| 10 Years | 1.27% | 2.03% | 3.13% | 1.64% |

| 15 Years | 2.06% | 2.73% | 4.20% | 2.65% |

| Since Inception (1/1/1995) | N/A | 3.89% | 5.98% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

June 8, 2020

Well, the stock market rectracement rally, of the huge drop earlier in the year, has retraced more and/or rebounded more than we thought. And, certainly, it is somewhat irrational. NABE just declared that a recession started in February of this year (2020) & unemployment is off the charts, etc. etc. etc. We previously documented that the economy was weakening back in the late 3rd quarter of 2019 based on Federal Reserve operations to the Bank Repo Lending Market (and again later in December 2019). The graph of the Fed’s balance sheet has now been published and it shows those times are when the Fed started dramatically growing its Balance Sheet (it had been contracting slowly for a couple of years, per their announced policies). Very importantly, we have yet to see the HUGE RIPPLE that is from the Corona Virus Lockdowns. Just around the corner are going to be multiple and huge bankruptcies – most obviously in the commercial real estate sector – but there will be lots and lots of sectors getting hurt and this contraction will spread from sector to sector to sector. Thus, it is amazing that stocks have been able to rebound so much. Another area is residential real estate – this sector should (eventually) be hit hard. We think this is true for all risky asset classes, especially those heavily financed with debt which most are. Certainly the risk level of essentially everything has stepped up dramatically, which means, in a rational market, buyers must be compensated more for the increased risk – by purchasing those assets at much lower prices. This goes for stocks, bonds, real estate, even precious metals (which are heavily financed and speculated in). In addition, at least the short term trend of high quality (U.S. Treasuries) interest rates is now upwards. We believe this small upward move is the beginning of a much larger move up in interest rates. One thing for Residential Real Estate is the mortgage rates have not gone up at all (even though the risk of default has skyrocketed). Although there has been a “stealth” rise in interest rates – We have read that it is now nearly impossible to get a jumbo loan – so while the quoted rate hasn’t risen, you can’t borrow at that rate; this situation is probably true for bank loans for any risky categories. In fact, we have read that several of the large banks have ceased to make automobile purchase loans! Unfortunately, we expect there will be all kinds of bad news about all these risky asset classes – how payments aren’t being made (or received) and how that is rippling around the economy.

Our belief is the stock market rally is about out of gas and the Huge initial drop that we forecasted will resume, with new a Huge drop down far below the low of earlier this year – with less liquid assets finally printing prices at much lower levels (so far mostly they are quoted as unchanged – think Residential Real Estate – there have been very few transactions/prints during the Lockdowns). Then, from that low, we should see another pretty big retracement before putting in the final leg down to an even lower low.

May 14, 2020

We continued to do well in these very volatile times. For April 2020, generally, the muni market got back a good part of its loses of the previous month during the first half of April, but then trended down (in price, up in yield) for the latter half of the month. In May, so far, the market has traded up (in price, down in yield) quite a bit. We find this amazing as the economic fundmentals being report are hugely negative and imply a definite large increase in default risk even possibly up to the highest credit-quality issuers. Of course, the wild card is government bailouts of which the municipal bond market is supposed to participate – just who or which, and how will be interesting.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 4-30-2020

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 0.86% | 2.46% | 3.78% | 2.07% |

| 3 Years | 1.26% | 2.48% | 3.81% | 1.72% |

| 5 Years | 1.06% | 2.17% | 3.34% | 1.53% |

| 10 Years | 1.34% | 2.05% | 3.15% | 1.69% |

| 15 Years | 1.97% | 2.71% | 4.16% | 2.53% |

| Since Inception (1/1/1995) | N/A | 3.89% | 5.99% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

April 16, 2020

As we forecast on March 14, 2020 (below) we more than caught up to the Morningstar average one year return for the period ending 3-31-2020, the only period we lagged. As we explained, during this recent very tumultuous period only the very very highest quality bonds rallied (prices up and yields down). In fact, what we didn’t expect was that even municipal bonds pre-refunded and escrowed in U.S. Treasuries would see their prices fall (yields rise). Of course, most of the mutual funds and privately managed accounts don’t have that high of credit quality so they fared worse. However, as we said last month, “Our credit quality is very high so we expect to earn monthly returns similar to those over the past many years” and that is how we performed. I would add to that that we had very low interest rate risk. So, during this very volatile period, we outperformed based on both credit quality and interest rate risk.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 3-31-2020

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 1.29% | 2.52% | 3.88% | 1.95% |

| 3 Years | 1.50% | 2.48% | 3.81% | 1.78% |

| 5 Years | 1.13% | 2.16% | 3.33% | 1.49% |

| 10 Years | 1.43% | 2.06% | 3.17% | 1.72% |

| 15 Years | 2.04% | 2.72% | 4.18% | 2.56% |

| Since Inception (1/1/1995) | N/A | 3.90% | 5.99% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

March 15, 2020

Whoa! Unfortunately, we pretty much nailed it when we wrote in these pages on January 27, 2020:

Importantly, we believe we can watch for breaks of the parabolic uptrends as indicators of declines in the broader markets. As, I’m sure anyone reading this knows, downside volatility has just stepped up rather dramatically, attributed to the Coronavirus breakout. We don’t know if that is the cause but we do know that the markets valuations and fundamentals seem a perfect setup to us (as we’ve documented in these pages) for huge potential price declines. We see a lot of indices that have curved up – maybe not dramatic parabolic rises, but if those with parabolic rises see their prices plummet, we would expect that the prices of these curved up price graphs will follow the new sharp downward trend. Some of these would be Bitcoin (which we have been using as a “canary in the coal mine” for quite some time), the price of gold. Others with more sideways rises (with lower and lower momentum) like U.S. Domestic stock indices and prices would also likely follow along as we’ve been forecasting.

We said similar things on January 28, 2020 in our January 2020 Annual Forecast:

Forecasts for 2020 – Given the super low interest rates, the huge debt levels, and the prices of most assets at extreme overvaluation levels, and the divergences – all of which we have been documenting (here and in our previous Annual Forecasts and Blogs ) – our forecast is fairly straightforward, at least to us. Last year, as discussed above, we hedged on forecasting “The Top” because the market is so irrational. However, this year we just had two “Liquidity Events” similar to those prior to the top before the Financial Crash down into 2009. And, interest rates are lower – and super low across the entire curve. Thus, we have a lot more confidence this year, unfortunately. Also, if those rising parabolic price graphs break, it will give us more confidence that “The Top(s) is in.” If it is “in” it will be obvious very quickly as price drops will be breathtaking – swift and large. So, we should get verification fairly rapidly. Importantly, even if we are incorrect, the upside potential of almost all asset classes is very very small, while the downside is very large (at least to us) – so, to us, it makes a lot of sense to be extra defensively postured.

So our forecast is for prices of U.S. Equities, junk bonds, commodities, real estate – pretty much all higher risk asset classes – to fall. Interest rates are a tougher call, but we will stick our neck out and forecast generally rising interest rates, since they are at such low levels and across the board/curve and because of the all-time yield divergence between the Ten Year and the Thirty Year that we documented. In fact, as we have gone over so many times previously, since, generally, assets are very highly leveraged across the board right now, rising rates from such low levels will put huge pressure on prices of assets.

Ok, so the stock market over the past three weeks has fallen about 28% to the period low, with a 9% or so rebound on Friday bringing it to still down about 20%. There is a lot of press on all of this so we are just handling the unfortunate highlights. Importantly, commodities (oil, which had already been dropping, dropped from $52.78 on 2-20-2020 by 41%! down to $31.13 on 3-09-2020, before rebounding a bit) also had extreme drops as did prices of junk taxable bonds (“JNK” fell almost 14% before a rebound) and high yield municipal bonds (“HYD” fell almost 27%!!! bigger than we expected, before a rebound). Remember, for bonds, prices down, yields up – so in this case yields were up substantially. However, interest rates of the very highest quality bonds, U.S. Treasuries, fell, at least at first, before putting in noticeable rises, but with their interest rates still below where they were when this debacle started – interest rates of short U.S. Treasuries and Bills just plain dropped! Even high quality municipal bonds failed to follow the lower yields of U.S. Treasuries. Also, Bitcoin, which we also mentioned, fell about 12%, not a huge move for Bitcoin but in the same direction. Gold (“GLD”) held up at first but then fell about 9% down into Friday 3-13-2020.

Treasury Yields – On 1-31-2020 the yield on the U.S. Treasury 30 year bond was 2%. During the intial part of this financial crash it dropped, during a flight to quality, down to Just below 1% on 3-9-2020, wow 50% drop in yield. However, since then its yield has rebounded to 1.55% on last Friday, 3-13-2020 – that is quite a rebound. We think the all-time low is in and that longer term U.S. Treasury rates continue to rise from here. We think what happens to yields of short term U.S. Treasuries is more difficult, at this time, to forecast; however, they are exceptionally low now with the 3 month T-bill yield at 0.27%, we would not be surprised to see them rise also.

So, as for our forecast, yes we believe “The Top is In” and that the parabolic rises have been broken or will be if they’ve not been already. Importantly, with respect to the Repo market and liquidity, the Fed has stepped up even more dramatically during this “crisis” to give a huge amount more liquidity (over $1.5 trillion) to short term borrowers using securities as collateral. Remember what we noted (in these pages) that what was happening in the Repo market was one of the tipoffs to our forecasts.

Ok, so now what? Unfortunately, we believe we are in the middle or so of this down draft. While we highlighted, recently and over the years, the huge debt bubble we are in, the reaction to the Corona Virus is certainly taking a toll not only on the prices of securities but on the general economy. To us, it does not appear like that effect has ended yet. And, we believe its effects are going to ripple. We believe it is for these reasons (assets priced to perfection, huge debt level financing them, a slow down in the economy, etc.) that prices of high yield municipal bonds have been demolished (“HYD” down almost 27%) – all kinds of tax revenues will be lower, lots of people are going to make a lot less, etc. – THE BIG RIPPLE, unfortunately, will most likely result in a lot of defaults – mortgages, lease payments, bonds, etc. Thus, everything with any type of risk (and/or highly leveraged) is being priced down. We do not think we are near the bottom of this repricing. We do think government actions will make the declines more orderly but we think the declines will likely continue. We think we are in about the middle of the down draft, so we would expect another 30% or so (or even more!) drop in equity prices, for example. Thus, at this time, we recommend against trying to “buy the dip” – right now, we see it more as trying to grab a falling knife. Also, we expect the volatility to continue to be severe – huge ups and down like we’ve seen (8%, 9%, 10% & larger!) daily, will likely to continue and make it very difficult to be successful, especially with the continued downward bias we are forecasting.

Of course, after huge price drops, eventually, there will be an incredible buying opportunity. We expect a huge spike low and then a big rebound similar to what we saw at the bottom of the Financial Crash in 2009 but even larger. We think it will be very difficult to know when that will happen ahead of time but it may be more obvious in real time (like 2009). After the initial rebound it will likely become very very choppy, with the rebound lasting substantially longer than the time it will have taken for the entire initial drop (which we are still in). Then, probably a choppy drop from the rebound top for years down to a lower bottom (below the initial crash low) – we believe this entire process will be represented as a huge, long term structure on price/time graphs.

Real estate – Of course, real estate takes much longer to trade than stocks or bonds but we have real estate mutual funds that we do follow. Unfortunately, as forecast, the iShares U.S. Real Estate ETF (“IYR”) fell almost 27% during this crash, so far – we, think, in response to all the other asset prices falling and the prospects of people not having as much money going forward for mortgage payments and rent payments, etc. Also, mortgage refinance rates are spread off of high quality U.S. Treasury rates (or similar). It is likely their spread will be widening as their likelihood of default has just risen. And, we are now forecasting at least interest rates of longer U.S. Treasuries to go up. So you could see a triple whammy against real estate prices, unfortunately. Again, at the bottom which, for real estate, we think would be years from now, much lower prices will allow those with cash to make bargain purchases (especially compared to the last few years). Also, of course, real estate is regional; however, this drop is global and will almost certainly negatively affect the prices of all real estate, unfortunately.

We want to emphasize the speculative nature of our forecasts and these markets, in particular, with their very high level of volatility. We definitely could be wrong. Also, implementation is another risk factor. We believe the markets will continue to be very risky with huge price moves up and down for a time – making it very difficult to not lose money, unfortunately. We believe emotionally charged markets like these increase the difficulties of being successful. As always, past success, of ours or anyone else’s, does not guarantee future results. Please read all the disclaimers all over our website. Be careful and be safe.

March 14, 2020

Still lagging a bit for the one year BUT as you likely know the markets went rather haywire in late February and especially early March 2020. We do not know the exact nature of the index nor the Morningstar Category except as far as “duration” -( i.e. interest rate risk) which is short but not as short as ours is. However, more important is credit quality as during this strange economic period only the very highest quality bonds saw their yields go down (prices up) but all others saw their credit quality yield spreads widen, most rather dramatically, so their prices went down (yields up). So, it will be interesting to see how the index and the Morningstar Category average fared during March 2020. Our credit quality is very high so we expect to earn monthly returns similar to those over the past many years. Over the rest of the year we are expect credit quality yield spreads to continue to widen and all interest rates, including the highest quality, to rise (prices down).

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 2-29-2020

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 3.33% | 2.54% | 3.91% | 3.81% |

| 3 Years | 2.08% | 2.51% | 3.86% | 2.24% |

| 5 Years | 1.47% | 2.14% | 3.30% | 1.76% |

| 10 Years | 1.55% | 2.10% | 3.23% | 1.82% |

| 15 Years | 2.13% | 2.72% | 4.18% | 2.63% |

| Since Inception (1/1/1995) | N/A | 3.90% | 6.00% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

February 13, 2020

Rates came back down a bit and we lagged for the one year because of our defensive posture but our long term performance is still excellent!

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 1-31-2020

| PERIOD | Morningstar Muni Short Category | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 3.25% | 2.50% | 3.85% | 3.78% |

| 3 Years | 2.08% | 2.44% | 3.75% | 2.31% |

| 5 Years | 1.33% | 2.13% | 3.27% | 1.65% |

| 10 Years | 1.50% | 2.11% | 3.24% | 1.82% |

| 15 Years | 2.09% | 2.71% | 4.17% | 2.58% |

| Since Inception (1/1/1995) | N/A | 3.90% | 6.00% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

January 27, 2020

Obviously, we have been trying to call “The Top” in stocks (and resumption of downturn in commodities) for quite a while. A month or so ago we started noticing some parabolic price rises. Importantly, we have used spotting parabolic rises to call quite a few major tops and associated downdrafts over the years in these pages. Most notable was the parabolic rise and huge collapse in the price of bitcoin. On August 8, 2019 we said (double quoting ourselves):

The most recent asset to see an incredible parabolic price rise decimated is BitCoin whose collapse we forecasted based on that parabolic rise. It is now down 67% from its parabolic peak of 12-16-2017. Just two days after that peak in these pages on 12-18-2018 we wrote:

‘Right now [Bitcoin] is quoted at approx. $19,000 – what is a few dollars when it is going up and down a $500 a couple of times per day. Anyway, from March 2017 it has risen in a parabolic rise (increasing at an increasing rate to now near vertical) by a factor of 19x, or by 1800%. Accordingly, other assets priced in Bitcoin (rather than U.S. Dollars) have dropped in price 95%! – an incredible crash – across the board – all of them, if priced in Bitcoin. It is rather astounding. Looking forward, obviously it is highly speculative. Bitcoin is in a bubble, but when things are this irrational you could see further huge gains and huge bouts of volatility, up & down. It maybe, when the stock market starts its huge drop, people will, at least at first, sell stocks and move into Bitcoin (this is what happened in 2000 in Real Estate after the Tech Top but before the Tech Wreck really got going) – so it would go even higher (of course, it may not – its run maybe near over). Bitcoin could go a lot higher. But, ultimately, we believe this bubble will burst with a drop all the way down to the levels that its parabolic rise started at – so $1,000 (a 95% drop) or even lower. Bitcoin’s “market cap” is huge, so a collapse would mean a lot of people would lose a lot of money, unfortunately.’

(Note we have written considerable commentary on Bitcoin and other indices that had parabolic price rises and their resolutions in these pages)

Recently, Tesla’s (“TSLA”) price graph is one of them – It is fairly easy to see in a five year graph. It may be easier to see on longer term charts. The low was in early May 2019 at around $155 – this is where this parabolic rise starts. It rises at an increasing rate up to just over $401 on 1-22-2020. The deal with parabolic rises is that the top is very difficult to forecast its top, as the more vertical it goes, the more it feeds on itself (instead of fundamentals) and it can go quite vertical, or not. While Tesla seems to be looking a lot of future competition from the major car manufactures (Porsche and BMW), its price has kept shooting up. Some people think the rise is driven by short covering. Could be, but what we know and have documented many times in real time is that these parabolic moves most often reverse quite rapidly and the price falls all the way down to the beginning of the price move.

Another huge parabolic move we have just run into is the price of the commodity Palladium. It has kind of a compound parabolic move but especially from a low in September 2018 at above $80 rising to a high near January 2019 at about $150 with a hiccup downwards to May 2019 at about $125 and then an even steeper move up to over $200 currently (a couple of days ago, when we first discovered it).

Another one is the spectacular rise in the Semiconductor Index (“SOX). Starting on 10-1-2008 at 445.49 and rising in a huge parabolic shape up to 1,945.37 on 1-23-2020.

Importantly, we believe we can watch for breaks of the parabolic uptrends as indicators of declines in the broader markets. As, I’m sure anyone reading this knows, downside volatility has just stepped up rather dramatically, attributed to the Coronavirus breakout. We don’t know if that is the cause but we do know that the markets valuations and fundamentals seem a perfect setup to us (as we’ve documented in these pages) for huge potential price declines. We see a lot of indices that have curved up – maybe not dramatic parabolic rises, but if those with parabolic rises see their prices plummet, we would expect that the prices of these curved up price graphs will follow the new sharp downward trend. Some of these would be Bitcoin (which we have been using as a “canary in the coal mine” for quite some time), the price of gold. Others with more sideways rises (with lower and lower momentum) like U.S. Domestic stock indices and prices would also likely follow along as we’ve been forecasting.