Extra Disclaimer – First, we want to emphasize the speculative nature of our forecasts and these markets, in particular, with their very high level of volatility. We definitely could be wrong. Also, implementation is another risk factor. We believe the markets will continue to be very risky with huge price moves up and down for a time – making it very difficult to not lose money, unfortunately. We believe emotionally charged markets like these increase the difficulties of being successful. As always, past success, of ours or anyone else’s, does not guarantee future results. Please read all the disclaimers all over our website. Be careful and be safe.

Introduction – This blog (in reverse chronological order below) will document and discuss our forecast unfortunately of the very very large economic contraction.

Importantly, we are seeing a market DOUBLE TOP! (12-17-2023) at least in the Dow Jones Industrial Average and we expect in the S&P500; however, we do not expect these tops to exceed those of late 2021/early 2022 by very much, and, importantly, we expect that few other indices nor market categories will see Double tops – i.e. they will be putting in “Lower Lows.” Importantly, these types of divergences are common at market tops. ([See our discussion on 12-17-2023])

For previous “real-time” market discussions, see The Beginning of the Super All-Everything Top – First Peak where we documented and discussed the Super Everything Top (in real time!). As with last time, we will include all the previous elements of the older blogs (- Deflation Watch – Elements of Market Tops– Major Trend Changes ) (where we forecasted the 2006-2007 major Housing Bubble top and the Financial Crash bottom in 2009) into the “The Contraction Resumes” and, then into this blog, “Calling The Super All-Everything Top” for the super top that we believed peaked in late 2021/very early 2022.

Also, see our Annual Forecasts where we Forcasted the 2000 Tech Top (before we were blogging) and several subsequent market bottoms & tops: Tech Wreck (bottom), Housing Bubble Top, & Financial Crash (bottom), etc.

Please note that, as we’ve discussed before, tops are usually rounded with various indices and media discussions occurring spread out over a longer time period than bottoms where they all spike down to the low together. Also note, the size of a rebound generally indicates the period of time required for all the various areas to top; thus, a very large top takes a long time to put itself in place. For example, the 2000 equity top actually saw some indices topping back as far as 1998 and as late as late 2000; the 2006/2007 Housing Bubble (and equities) top was actually spread out over four years. With that said, this downturn will almost certainly be just as large and we think even larger, unfortunately

The Reverse Chronological Commentary Starts Here (directly below):

6-23-2025 The Markets – The Equity Markets have continued their retracements of their large drops documented below. The S&P 500 and the NASDAQ have recouped the most by far with the Dow Jones Industrials lagging and all the other indices still further behind. However, usually when Indicies get that close to making new high, they do. Although we saw in the late 2024 and early 2025 divergences (documented below) that this is not always the case. We expect these divergences to continue. From this point, our expectation is a slight new All-Time High by the S&P 500 shortly and likely by the NASDAQ. However, we think it is much less likely for the Dow Industrials and not likely at all for others like the Russell 2000 and the Transports, etc. Thus, the “Big Round Super Top” that we’ve been forecasting & documenting will become even broader in terms of time and shape, which, of course, is appropriate for the largest stock market top in history. What happens after that could be “very interesting.” We see see many fundamental signs that the economy is slowing. Also, we see that prices are actually dropping in some areas like in real estate and also dramatically in used goods that we follow – it seems there is a glut. Of course, that is the opposite in what we have just seen in prices of gold and silver. So, while the underlying economy seems to be weak and weakening, the markets are, or rather, have been “cresting” for quite a while. After the Crest, comes the drop. We still believe the tariffs are deflationary and we are just starting to see their impacts. Then there are the wars. There is a lot going on. As for bonds, as forecasted, the yield curve has been steepening but more with the shorter end dropping, a bit but not enough for the Fed to cut rates, so far. We continue to expect long rates to rise further and the impact of rising longer term rates to put downward pressure on prices of highly leveraged assets. Of course, we will see.

6-18-2025 Our Most Recent Tax-Free Performance & The Muni Market – The short term muni market had another good month bringing the current twelve month returns ending 5-31-2025 up to very respectable levels. We like to point out that our return was achieved with less volatility. This can best be seen by looking at the variability of the longer term performances (in the table below), especially for the 5 Years, 10 Years, and 15 Years periods.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 5-31-2025

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 3.59% | 4.01% | 6.16% | 4.16% |

| 3 Years | 2.46% | 3.15% | 4.85% | 2.27% |

| 5 Years | 1.32% | 2.56% | 3.94% | 0.99% |

| 10 Years | 1.37% | 2.33% | 3.58% | 1.47% |

| 15 Years | 1.40% | 2.18% | 3.35% | 1.56% |

| Since Inception (1/1/1995) | N/A | 3.65% | 5.62% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

5-18-2025 Our Most Recent Tax-Free Performance & The Muni Market – The short term muni market had a nice improvement for the current month so did we. While we both gained, the average gained an extra 7 relative basis points for the current twelve months; however, our lead in all periods below is very strong.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 4-30-2025

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 3.15% | 3.99% | 6.14% | 3.36% |

| 3 Years | 2.53% | 3.06% | 4.71% | 2.44% |

| 5 Years | 1.52% | 2.49% | 3.83% | 1.24% |

| 10 Years | 1.28% | 2.31% | 3.55% | 1.38% |

| 15 Years | 1.39% | 2.18% | 3.35% | 1.54% |

| Since Inception (1/1/1995) | N/A | 3.65% | 5.62% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

4-13-2025 The Markets – “It’s The Bond Market – silly!” As you know, we’ve been forecasting yields of longer bonds to resume their upward rise across the yield curve to steepen it. And, that is what has been happening. In fact, the yields of the U.S. Treasury 30 Year Long Bond and the Ten Year both rose by around 40 basis points last week. There is a lot of chatter about the size and quickness of those rises. It is important because so many interest rates are “based” (“priced”) off of the U.S. Ten Year. In fact, there is a lot of concern, that is probably justified, that rising interest rates are/will cause some more “sophisticated” investment schemes to blow up and have to be liquidated. That situation could very well be the impetus of the recent huge downside price volatility in the the stock market.

Importantly, the short end of the Yield Curve is mostly unchanged, so we are getting the steeper yield curve we have been forecasting – resulting from higher long term yields, not from lower short term yields, which was part of our forecast (see previous days’ commentaries). It is important to us, because rising longer term yields normally means investors are not currently concerned about inflation. If inflation is a primary concern, the yield curve would be “inverting” with shorter yields higher than longer term yields – that is not what is happening. Thus, the continued steepening of the yield curve goes along with our disinflation/deflation forecast. Actually, we think we may be just beginning to see a “GREAT UNWINDING” as interest rates rise to reflect notable increases in perceived risk. Rising interest rates will push down prices of pretty much everything (see below) which could force asset liquidations, which would push prices down even further – kind of a self-reinforcing cycle, unfortunately.

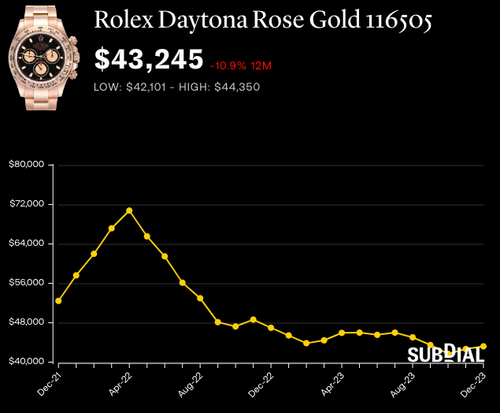

Disinflation/Deflation – Stocks & Commodities – In addition, rising interest rates normally will take a toll on assets positions that are heavily financed (unless we are in an inflation). We have been reporting on the continuing downtrend in prices in various sectors – Industrial Commodities like oil, used consumer goods on Ebay and Craigslist, Industrial-Financial commodity silver, etc. Importantly, the rises in interest rates generally correlate with falling stock prices (and falling housing prices). In fact, both the equity markets and the bond market have just experienced very large levels of volatility: net down for stocks and bonds and up for interest rates. Prices of Industrial Commodities have also dropped notably.

Gold – Gold, “The” Financial Commodity, has been in a parabolic uptrend that started in 2016 at around $1,000 per ounce. Its rise has been increasing at an increasing rate and is now almost vertical. We’ve reported on similar parabolic rises and collapses in various asset classes several times in these pages over the many years. One we did not report on was Gold’s previous parabolic rise from $300 in 2001 up to $1900 in 2011. Note, that rise is not as steep as the current rise. We normally see that once a parabolic near-vertical rise is over, the asset’s price drops all the way back to the beginning of the rise. However, in this case it dropped only back down to $1,100 in 2016 – still a significant drop. That level could be seen as the beginning of the current parabolic rise but it has a “continuity break” in its rise from then with the other potential starting point being $1,600 in 2023. So, with the bond market signaling “Deflation” and gold in the near-vertical portion of a parabolic rise, we are looking for Gold to top and drop significantly, down towards the 2023 low/starting point, if not lower. And, there is another piece to this picture (see below).

U.S. Dollar – And, we see another piece to this picture, which involves not only Gold, but other Commodities, and Stocks, and Real Estate, and longer term Bonds – and that is the U.S. Dollar. Lots of people are very concerned about the U.S. Dollar and we are too but, we believe that if we are going into a “deflation,” the U.S. Dollar will by definition go up in value, at least with respect to prices in the U.S. Yes the U.S. Dollar has been heading downwards sharply just as Gold has been heading up nearly vertically. But, we believe these directions will change abruptly with U.S. Interest Rates rising. Thus, we are expecting the U.S. Dollar to begin a notable rise – accordingly, essentially everything priced in dollars (at least domestically) will be falling in price. This is the situation we forecast and what happened for the Financial Crash (2007-2008) down from the Housing Bubble Top (2005-2007). Similarly, we expect the prices of real estate will be dropping.

Looking Forward – If we are correct with the several related forecasts above, we expect large moves and volatility in all markets – U.S. Dollar up along with rising interest rates and with prices of pretty much everything else dropping – the more leverage/debt/derivatives/futures/”Basis Trades”, etc. in an asset class, the more the prices will likely drop as they are unwound, sold, etc. It seems we are in the grip of lots of market turmoil; we expect it will continue for some time. Bear Markets typically last for several years and sometimes much longer, unfortunately.

4-13-2025 Our Most Recent Tax-Free Performance & The Muni Market – The short term muni market lost a bit for the current month while we added a bit. Bottom line is that we improved for the current twelve months while the Short Term Muni Average dropped off a bit. Looking forward, given the turmoil in the equity markets, we expect high yield (i.e. riskier with respect to credit quality) muni’s will have a tougher “go” going forward. Of course, we will see. Similarly, we expect longer duration (generally longer maturity) muni’s will also have a tough time. Again, we will see.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 3-31-2025

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 3.06% | 3.95% | 6.08% | 3.36% |

| 3 Years | 2.26% | 3.03% | 4.66% | 2.23% |

| 5 Years | 1.50% | 2.49% | 3.83% | 1.34% |

| 10 Years | 1.30% | 2.30% | 3.54% | 1.42% |

| 15 Years | 1.43% | 2.19% | 3.36% | 1.60% |

| Since Inception (1/1/1995) | N/A | 3.65% | 5.62% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

4-8-2025 The Equity Markets – Whoa, as forecast, the “huge volatility has continued” although the net progress has been muted because the volatility was Up and Down with a good portion of it hidden in “intra-day” moves. For example, in the Dow Jones Industrial Average, on 4-7-2025 (Monday), opened at around 37,060 (Friday’s Close) and quickly shot up around 1,640 points to around 38,700 (the high for the day) on a Trade Rumor! that was then discredited resulting in a drop of about half of that gain. After a few large gyrations it closed at around 38,000 for the day’s net rise of 940 points but still 700 points below the day’s high. We note that the 1,640 largest “intra-day” rise was a 31% retracement of the drop from the intermediate high of 42,380 (or so) on 4-2-2025 to the day’s low. Of course, it was a smaller percentage from the higher intermediate top before/above that of around 42,757 on 2-25-2025 and the essentially double top of 44,960 on 1-25-2025 and the ever so slightly higher All-Time Top at about 54,030 on 12-24-2024. However, we believe that retracement should be considered in conjunction with the lowest of those highs that we used.

Then on the next day (today, Tuesday) we saw similar volatility. The Industrials starting from the previous close of around 38,000 shot up by 1,400 points to the day’s high of 39,400 on more Trade Information but then, additional “Trade Sparing” shot the Industrials down by approx. a whopping 2,285 points to the day’s low of 37,115. It then rebounded by 530 points to close at about 37,645. The day’s net was a drop of about 355 points. While that 1,400 counter-trend rally was very large it was dwarfed by the immediately following drop of 2,285 points, mitigated somewhat by the 530 point rise into the day’s close.

We see this level of Huge Up and Down Volatility as a likely “confirmation” we are in a Bear Market and we expect it to continue. Ultimately, we expect further NET large drops as detailed below, unfortunately. The Drops should be ultimately 2 to 3 times larger than the rises – something like that. Maybe a couple more large net drops (with similar intra-day counter-trend moves to what we just saw) before we have a GIANT counter-trend rally/retracement like we detailed below with respect to “The Tech Wreck” and “The Financial Crash,” from dramatically lower lows. We expect violent rises and drops will be fueled by rumors, announced negotiations, etc. and associated short covering and people trying to buy the bottom. We believe it will likely be very tough market conditions for most.

4-6-2025 (Sunday) The Equity Markets – The Crash – Last Time (on 3-23-2025) we said, “We expect some more choppy rebounding and then a turn down to substantially lower lows,” and that is essentially what happened: we saw a choppy rebound for a couple of days and then the markets turned down hard to substantially lower lows. The headlines are calling it a “crash” and that is what it is. In the resumption of the downtrend on the Dow Jones Industrial Average, it first put in a bit of a low followed by a slight rebound and then fell by almost 9.5% to a closing low two days later on Friday, 4-4-2025. This drop brought the Dow Jones Industrials “Drop from the Top” to down 14.9% or down by about 6,700 points. The S&P has similarly negative numbers. From their All-Time Highs, the Russell 2000 is now down about 26% and the NASDAQ is down 22.7% – so both officially in “Bear Markets.” Note: that these markets saw their All-Time-Top spread out at different times (see Previous Discussions); some just by a hair and that points out that this is a big round/flat top as we’ve discussed many times. Importantly, we believe The Tops Are In – wow, this has been a Huge Top! and in so many asset classes: Stocks, Bonds (a few years ago), Real Estate, some commodities (Gold).

Also, as we’ve forecasted, the Industrial Commodities also went down. Oil dropped 14% over the past two days. Silver, kind of a hybrid Industrial-Financial Commodity also dropped 16%. Gold however, held up better dropping only a bit under 5%. We expect Industrial Commodities to follow along with stocks. Gold is a bit of a different animal but we definitely would not bet the ranch that it is going to rise while we are in an Overall Deflation, which is what we are forecasting.

Looking forward, with respect to Equities, we believe this current decline is only about half over. So the Dow Industrials are currently down 14.9% or by 6,700 points. Thus, while we do expect some sharp & choppy rebounds, we don’t expect a Huge counter-trend rebound (see below) in stocks until we are thousands of points and a number of percentage points lower. A rough guess would be the Down would drop by up to another 14.9% or so – maybe up to 6,000 or so more points down – Then, we would see a Huge Counter -Trend Rebound like I talked about directly below. Of course, subject to change in these super fast markets as conditions change. We forecast that the recent huge volatility will continue. “Safety” should likely be emphasized for most “investors” over trying to make big profits. Actually, when markets are so far above “fair value,” we like to call it “speculating/speculators” – and, we think it has been in “Speculation” mode for many years now. The dominoes have been in place for a long time; it was only a matter of time before something would finally trigger a huge decline. Also, typically, Bear Market declines go below “Fair Market Value,” often by a considerable amount, just as this “Bull Market” had “bubbled” above “Fair Market Value,” by a considerable amount.

BEAR MARKET COUNTER-TREND RALLIES – I just copied what we wrote in our February 8, 2014 Update as we think it is still valid (so, here, we are quoting ourselves in 2014 quoting ourselves in 2008). The important idea is that we expect there will be some very large counter-trend rallies in the context of our forecast for the Huge Downtrends overall. Here it is:

“Here is come commentary Here is some commentary from our 2008 Annual Forecast (dated 1-24-2008) – we were looking at what we saw in the drop from the 2000 top to anticipate what we expected was going to occur from 2007 top:

We looked at the drops in equities from the 2000 top to the 2002 bottoms [The Tech Wreck] focusing on the percent rise of retracements of intermediate drops during the overall downtrends. Here is what we found:

………………………………….First Second Third Total

………………………………….Retracement Retracement Retracement Drop

Dow Jones Industrials 76% 76% 50% 38%

S&P 500 50% 62% 38% 49%

NASDAQ 50% 24% 62% 78%

Thus, even though there were huge retracements of large drops, at the end of the period (in late 2002), the DOW bottomed down 38%, the S&P bottomed down 49% and the NASDAQ bottomed down a whopping 78%. In that light we expect large counter-trend retracement rallies similar to those experienced during the drop from the 2000 top. However, given the poorer fundamentals at this time than even at the 2000 top, we are forecasting smaller retracements – probably more like 24% as opposed to 50% or 76%.

Still, it will be tough to not think the downturn is over when it is simply a large counter-trend rally. Of course, if the stock market is dropping precipitously, real estate will be falling hard and low quality bonds will be seeing their interest rates rise (prices drop) rather dramatically. We think the recession will last throughout 2008. We will forecast 2009 next January.

And, our forecast was pretty much right on, especially compared to the financial media and most financial commentators. Here is what happened from the 2007 top down to the 2009 bottom [The Financial Crash]:

………………………………….First Second Third Fourth Total

………………………………….Retracement Retracement Retracement Retracement Drop

Dow Jones Industrials 76% 62% 38% 38% 54%

S&P 500 76% 60% 50% 38% 57%

NASDAQ 60% 65% 76% 30% 55%

Russell 2000 91% 62% 76% 36% 60%

You can see the retracements were a bit smaller than from the 2000 top (quote above) although there were more of them and the overall drops were larger. We added the Russell 2000; you can see that it has even bigger retracements but ultimately lost the most!

We expect those same types of large counter-trend retracement rallies to occur during this major decline. Just like the previous two times, they should be big enough to allow “reasonable” people to believe that the downturn is over.”

3-23-2025 The Equity Markets – We have had pretty much a repeat of the divergences we reviewed on 1-31-2025 except that we Now have had more notable declines including from the one indice with a new All-Time Top. Thus, the size of “The Top” has widened even more in time and ever so slightly in price as the new All-Time Top is incredibly close to the previous ones (as are some of the “misses” for a couple other indices – It looks to be a huge flat top.

First, some returns of those that had All-Time Tops back on 11-25-2024 and recent bottoms on 3-13-2025: Dow Jones Transports down 19%; S&P Small Cap (“IJR” proxy) down 19.5%, Russell 2000 down 18.5%. Note “Down 20%” is considered a “Bear Market” so we are close in those indices. Then, the Dow Jones Industrial Average with its All-Time Top still back on 12-4-20-24 and a drop to its recent low on 3-13-2025 of 8.7%. Then, the NASDAQ Comp and Future (“NDQ”) both still have All-Time Tops a little later, on 12-16-2024, and recent bottoms on 3-13-2025 with drops of 14%. Now the one (same as last time) with new All-Time Top – the S&P 500 on 2-19-2025 with a recent bottom on 3-13-2025 and a “drop from the top” of 10.3%. Note “Down 10%” is considered a “Correction.”

Since all those bottoms on 3-13-2025, we have had fairly choppy mostly sideways rebounds in all indices. Of course, the question is, “Are the tops in or are we going to do this again?” Of course, we do not know but given all that we’ve reviewed previously over the years and recently, we think there is a high probability that “The Tops are In” especially those that topped longer ago and have dropped more, and that the upside potential is not adequate for the downside probability. We expect some more choppy rebounding and then a turn down to substantially lower lows.

3-17-2025 Our Most Recent Tax-Free Performance & The Muni Market – The short term muni market rebounded a bit more for the current month resulting in a increase in performance. Our return also rebounded, but less; however, our return started quite a bit higher and we maintained that lead for the current twelve months and much more so for the longer periods (see table, below).

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 2-28-2025

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 3.41% | 3.82% | 5.88% | 3.31% |

| 3 Years | 1.91% | 2.95% | 4.54% | 1.70% |

| 5 Years | 1.19% | 2.45% | 3.78% | 1.09% |

| 10 Years | 1.33% | 2.28% | 3.50% | 1.43% |

| 15 Years | 1.43% | 2.20% | 3.39% | 1.57% |

| Since Inception (1/1/1995) | N/A | 3.65% | 5.62% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

2-14-2025 Our Most Recent Tax-Free Performance & The Muni Market – The short term muni market rebounded resulting in the current twelve month total return increasing quite a bit (in conjunction with a poor performing month dropping off); however, even with our lower level of price and return volatility, we also picked up a bit of performance and are still pretty far ahead of the category average total return. This situation was true for most of the periods – please, see table below. We note that the short term U.S. Treasury yields, to us, seem to be quite a bit higher relative to short term average municipal bond yields (which we think are “too rich”), historically (and mathematically when taxes are taken into account); thus, we would expect short muni’s to have a bit of a “tough go” at least relative to U.S. Treasuries over the next several months.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 1-31-2025

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 3.07% | 3.80% | 5.85% | 2.79% |

| 3 Years | 1.70% | 2.82% | 4.34% | 1.40% |

| 5 Years | 1.18% | 2.43% | 3.74% | 1.04% |

| 10 Years | 1.24% | 2.26% | 3.48% | 1.34% |

| 15 Years | 1.43% | 2.21% | 3.39% | 1.56% |

| Since Inception (1/1/1995) | N/A | 3.65% | 5.62% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

1-31-2025 The Equity Markets – More Important Divergences? Final Equity Top(s)? In our previous Market Comment (below) we talked about more potential All-Time Equity Highs being “In” (for those where it wasn’t already evident). Since then, the Dow Jones Industrials, the S&P500 and the NASDAQ have shot back up to very very near their previous All-Time Highs. Usually, when indices get that close to achieving a new notable high, they do so (using Closing prices) but not this time so far. Only the S&P500 Cash (the normal one you buy – not the Futures) did put in a new All-Time High on 1-23-2025 at 6,118, 28 points above its previous All-Time High of 6,090 on 12-6-2024. But the S&P500 Futures just missed! at 6,152 on 1-23-2025 it was still 2 points lower than its All-Time Top of 6,154 on 12-16-2024. The Dow Industrials Cash was also just shy by 132 points at 44,882 on 1-30-2025 as compared to its All-Time High at 45,014 on 12-4-2024. The Dow Jones Industrial Average FUTURES was also close, but no cigar – its 12-4-2024 All-Time Peak is still 51 points above its second highest peak on 1-30-2025. Both the NASDAQ Comp (cash) and the NASDAQ Futures (NDQ) also missed taking out their December 2024 All-Time Highs and by more than the other misses and have since turned down a bit more. Importantly, essentially no other equity indices were close to achieving new All-Time Highs. Importantly, the U.S. Government announced Tariffs on China, Mexico and Canada on today, Friday 1-31-2025. Apparently, fears of a Trade War pushed the equity markets down from the previous market tops (yesterday or a bit earlier, depending). Since they got so close with only one putting in a New All-Time High (and because essentially all other equity categories were already much lower), it may be that The Tops are all in. Of course, we will see. Big Equity Tops are very “rounded” with some happening earlier and some later.

1-17-2025 Our Most Recent Tax-Free Performance & The Muni Market – As discussed previously, the bond market had a tough December 2024 (interest rates going up; bond prices dropping), including short term municipal bonds. However, The Stamper Capital Average had a good month and actually picked up 5 basis points for the current twelve months ending 12-31-2024. Unfortunately, the Municipal Short Term Category had a bad December 2024 and a very good month dropping off giving it a decline of 138 basis points for the current twelve months. Thus, for the one year we went from a slight underperformance to a large outperformance (see table below). Also, we increased our outperformance in all longer time periods. So, we had quite a return for the year, and with less volatility, which many consider a measure of risk; thus, matching or long-term goal of trying to maximize Risk-Adjusted Performance (as we did with The Fund for 20 years; and, hence, the name of our website!).

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 12-31-2024

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 2.54% | 3.75% | 5.76% | 2.04% |

| 3 Years | 1.10% | 2.74% | 4.21% | 0.66% |

| 5 Years | 1.20% | 2.38% | 3.66% | 1.07% |

| 10 Years | 1.25% | 2.25% | 3.47% | 1.35% |

| 15 Years | 1.39% | 2.21% | 3.40% | 1.55% |

| Since Inception (1/1/1995) | N/A | 3.65% | 5.61% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

12-29-2024 The Bond Market – The bond market had a tough month. As forecast interest rates of longer bonds have begun (resumed) their rise and the yield curve has begun to steepen. The yield of the U.S. 30 year “Long Bond” rose from an intermediate bottom on 12-2-2024 of 4.32% to 4.82% (on 12-27-2024) or by 50 basis points. That is a significant move and, not only that, it broke a previous “higher low” of 4.62% and is now at the next “higher low” of 4.82% on 4-25-2024. But, even more important, the next step is the All-Time Yield High since the All-Time Yield low (1.05% 4-20-2020). That All-Time Yield High is 5.02% on 10-24-2023. If the yield of the U.S. Thirty Year breaches that level, we expect the trend of rising yields to continue & asset prices in general will almost certainly take a hit. Importantly, the U.S. 10 Year yield is in a similar situation. Thus, the yield curve has steepened and we expect it to continue to do so with longer yields rising. We are less certain on the short end of the yield curve.

Equities – Most U.S. Equities had been trending downwards from All-Time Tops over the past month or longer (depending upon the category) but they took their largest hit on 12-18-2024 in conjunction with the largest rise in interest rates during the period. We note that at this time we are seeing potential highs in place in most equity categories (also Junk Taxable Bonds and High Yield Municipal Bonds). We will take yet another stab at it – If longer term interest rates continue to rise as we are forecasting (above) and break through their All-Time Highs (since their All-Time Lows), we expect equities, in general, to be clobbered similarly & that The All-Time Tops Will Be In. Real Estate and all other asset categories that are heavily financed should also trade down accordingly. We do note that Sales Volumes (transactions) of single family houses have been contracting. Generally, we find that sales volumes contract/fall, before asset prices fall. We note that real estate sales volumes in our local market seem to have come to a standstill. So, the recipe for their prices falling (in addition to rising interest rates) seems to be in place, unfortunately.

12-19-2024 Our Most Recent Tax-Free Performance & The Muni Market – The Rolling returns of the short duration municipal bonds had a strong month drop off, resulting in a large drop in the rolling twelve month returns. Performances were still very strong as you can see in the table below; however, it let our accounts tighten their 12 month returns compared to the Category Average. Of course, as has been the case for a long time, we easily outperform for all longer periods – see the table below.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 11-30-2024

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 3.92% | 3.71% | 5.71% | 3.38% |

| 3 Years | 1.24% | 2.68% | 4.12% | 0.79% |

| 5 Years | 1.31% | 2.31% | 3.55% | 1.18% |

| 10 Years | 1.28% | 2.22% | 3.42% | 1.38% |

| 15 Years | 1.43% | 2.21% | 3.40% | 1.58% |

| Since Inception (1/1/1995) | N/A | 3.65% | 5.61% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

11-20-2024 Our Most Recent Tax-Free Performance & The Muni Market – The short end of the bond market continued to trade off during November 2024 and so did the municipals. We actually put in a very nice positive performance for the month while the Category Average lost 45 basis points and the Short Muni Index lost 57 basis points. For the current twelve months (including the new month and the month that dropped off, our Tax-Free total return improved by 5 basis points to 3.92% while the Category’s dropped 48 basis points down to 5.47% and the Index’s dropped 74 basis points down to 6.04%. We still lag for the current twelve months but our lead increased for all other time periods reported below (and with less volatility). Looking forward, still looking for the yield curve to steepen with longer bonds trading off (interest rates going up).

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 10-31-2024

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 5.47% | 3.92% | 6.04% | 5.43% |

| 3 Years | 1.07% | 2.62% | 4.02% | 0.63% |

| 5 Years | 1.20% | 2.26% | 3.47% | 1.12% |

| 10 Years | 1.19% | 2.20% | 3.39% | 1.32% |

| 15 Years | 1.43% | 2.21% | 3.40% | 1.61% |

| Since Inception (1/1/1995) | N/A | 3.65% | 5.61% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

11-10-2024 Post-Election Summary – On the day after the U.S. National (and regional) elections, or on November 6th, 2024, most equity markets saw solid gains. The Dow Jones Industrial Average gained 1,508 points or 3.6%! And, in fact, some of the medium term Equity Indice divergences that we had been noting were “taken out.” For example, the Russell 2000 finally moved up to a new All-Time High to join the Dow Jones Industrials and the S&P500, etc. However, while that move was notable, more notable to us, was the 3 point drop (about 3%) in the price of the U.S. 30 Year Long Bond. That drop is also notable and the Bond market is about 3x as large as the stock market. Still, we note that some components of our short term equity forecast have been dislodged (at least temporarily). However, the fundamentals are still there – huge debt levels on a weak economy with prices in various areas already dropping somewhat. In addition, we think potential national policy changes that are being talked about are likely to be deflationary, especially with prices in various markets so high along with huge record debt levels. Implementation could be very tricky. We still think the All-Time Equity (Double, Second) Tops are very close by and do not expect current levels to be exceeded by much.

11-3-2024 Equities – We did get another rise in the Dow Jones Industrial average of under 1,000 points as we forecasted in our previous update. The Dow Jones Industrial Average moved up another 412 points to put in a new All-Time High on 10-18-2024 at 43,275. This is within the levels we have been forecasting. Importantly, not only do we see a reasonable ending upward structure, we now see a reasonable beginning downward structure, down 1,512 points to 4,1763 on 10-31-2024. The S&P500 also put in a new All-Time Top on 10-18-2024 and has dropped a smaller percentage. More interesting is the NASDAQ – The Comp put in a new All-Time High but the NASDAQ 100 did not. So we have that “Divergence” which is common at tops. Of course, the Major Equity Market Divergences are all the other equity indices that peaked six months to a year and a half ago. Importantly, both the NASDAQ and the NASDAQ 100 have put in what looks to us to be reasonable downward structures. Thus, we are more confident that these lagging All-Time Tops are in. But, of course, we will see. Action more close to the election might be interesting.

Interest Rates – Long term interest rates dropped quite a lot from May 2024 to September 2024; the yield of the U.S. Long Bond dropped 88.5 basis points, a large move. However, since then the yield has risen by 65 basis points taking back about 75% of that previous yield drop. And, the U.S. 10 Year has pretty much matched those moves. Important to us is that we think longer interest rates will continue to rise and breakout above their May 2024 yield highs. If that happens, we think the next stop will be the May 2024 high or 4.82% and then a bit above 5%. It currently sits at 4.59% so just getting to those levels is a notable move but we expect it could easily go much higher. The short end of the yield curve has also been rising but not as much as the long end. We have been forecasting that the Inverted Yield curve would be resolved by long rates rising in addition to short rates dropping. Right now if you look at the 2 year compared to the 30 year (which is how the pros normally look at it), the yield curve is no longer inverted (but is very flat). However, if you look from the 2 year to the 1 year to the 6 months to the 3 months, even to the 1 month, it is clearly inverted and definitely not “normal.” As we mentioned previously, we will look at the entire yield curve. As we have talked about many times, if interest rise, we expect assets that are heavily financed like stocks and bonds and even commodities will see their price fall proportionately, on average. We see possible, very interesting times ahead.

10-14-2024 Our Most Recent Tax-Free Performance & The Muni Market – The short end of the bond markets, including municipal bonds, rallied even more and the Index and the Short Muni Categories saw their short term returns shoot up. We tagged along but lost some of our out-performance. But, if you look at all longer periods we still shine. Looking forward, rates have dropped a lot and, most of the Category’s and Index’s short term returns are in the form of capital appreciation from prices rising as rates dropped. The result is that their average current yields are now much lower; thus, will generate less tax-free income going forward, and the upside price potential is also lower after such a great price rally. So, we are expecting our average to outperform fairly easily going forward.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 9-30-2024

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 5.95% | 3.87% | 5.95% | 6.17% |

| 3 Years | 1.20% | 2.51% | 3.86% | 0.72% |

| 5 Years | 1.35% | 2.24% | 3.44% | 1.33% |

| 10 Years | 1.26% | 2.19% | 3.37% | 1.38% |

| 15 Years | 1.42% | 2.19% | 3.36% | 1.63% |

| Since Inception (1/1/1995) | N/A | 3.65% | 5.61% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

10-13-2024 Equities – We did get the little drop we were looking for in our last update – on 10-7-2024 the Dow Jones Industrial Average put in an intermediate low at 41,835. Since that low, we believe we already have a rise large enough to finish “The Top” (All-Time for the Dow and the S&P 500, as almost all other indices had their All-Time Tops six months to two years ago). Right now the Dow Jones Industrial Average sits at 42,863 or up a little over 1,000 points from that 10-7-2024 bottom. We believe “The Top” could be “Now to up another 1,000 points or so.” Unbelievable accuracy (if correct) I’m sure, but we will see.

10-6-2024 Equities – As we speculated previously, both the Dow Jones Industrials & the S&P 500 put in new All-Time highs but essentially no other indices did – the Nasdaq and its Futures is closer and most other indices are still far below. We expect choppy slightly rising conditions to continue again- We note the beginning of this rise which we date as early to mid August 2024, is slowly losing momentum – which is usual for an equity market top (which is usually rounded). We would not be surprised to see a slight drop and then another rise to All-Time New Highs at least by the Dow Jones Industrials – a rise of up to about 2,000 points which is not really a lot percentage wise (and relative to the down side risk). The S&P 500 could tag along or diverge. The Nasdaq could do it with a spike high but we think that unlikely as at the top are usually divergences. We are looking for this top just before or, maybe, after the election (so pretty soon) – if it happens that way, we think this will be the Final Top for these last indices – others’ All-time Tops were two years to six months ago. It could happen for many reasons – The dominoes have been in place for many years. The war seems to be escalating and long term interest rates look, to us, to have resumed their rise from their 2020 bottom.

Interest Rates – As we speculated previously, the Federal Reserve lowered its rate by 50 basis points. Many think that was too much, but, as we showed below previously, the short term U.S. Treasury rate yield drop allowed for a 75 basis point cut (indicating, to us, that the economy is weak). More importantly, looking forward, to us, is that the Yield Curve is still inverted, even with the drop in yields at the short end of the curve. And now, to us, it looks like the longer term rates have resumed their rise from their 2022 bottom. Most professionals look at the difference in the yields of the Two Year and the Thirty Year to see if the Yield Curve has a normal Slant, but, to us, at least in this case, that leaves too much information out of the picture. If you look at it that way the Curve is already “back to normal” (not inverted) as the yield of the Two Year is 3.93% and the 30 Year’s is 4.25%. But if you look at the short end, the Curve is still pretty inverted; for example, the One Month Bill yield is 4.79% or 86 basis points higher than the Two Year. And that situation is true for the belly of the curve. So things are not quite right. We think the short end could come down more but, more importantly, that the long end will be rising noticeably. If the belly of the Yield Curve and the Long End do see noticeably rising interest rates, we would expect that asset prices would fall. We do note that, amazingly, this did not really happen to Real Estate prices during the rise in yields from their All-Time Lows (1.05% on 4-20-2020). However, this time the rise in interest rates would be starting from much higher levels. We think such a rise in interest rates would also impact prices of Precious Metals and also Industrial Commodities – Interest [financing] rates up, prices down. Of course, if war(s) break out, we could see some unusual price action in many commodities.

9-19-2024 Our Most Recent Tax-Free Performance & The Muni Market – The short end of the bond markets, including municipal bonds, rallied (prices up, yields down) again in August 2024. The Short Term Category Average was up several basis points over the shorter run periods but the month’s performance did not make much difference for the longer periods measured. Surprisingly, we did just a bit better in a similar pattern – & poorer performing months dropped off of the periods measured. The Short Term Municipal Bond Index did the best, as expected as it has no fees, etc. and has the most volatility – so it goes up more but it also goes down more.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 8-31-2024

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 4.65% | 3.60% | 5.53% | 4.57% |

| 3 Years | 0.96% | 2.44% | 3.75% | 0.62% |

| 5 Years | 1.19% | 2.22% | 3.42% | 1.12% |

| 10 Years | 1.21% | 2.15% | 3.31% | 1.33% |

| 15 Years | 1.47% | 2.21% | 3.40% | 1.65% |

| Since Inception (1/1/1995) | N/A | 3.65% | 5.61% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

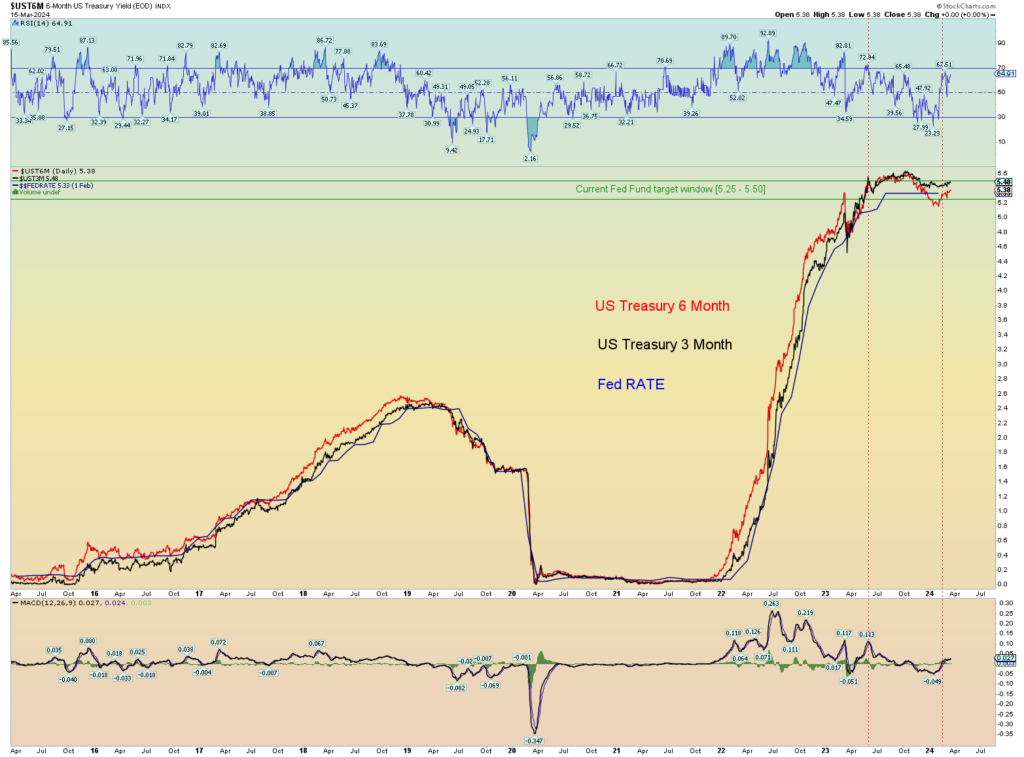

9-18-2024 Interest Rates – Pending Fed Cut – The Federal Reserve has announced it will lower the Fed Funds rate today at 2 p.m. Eastern. Market prognosticators are speculating on how much the Fed will cut. What is very interesting to us is that “The Common Wisdom” is that the Fed sets the rates and the market follows. However, as we have discussed several times, we believe the Fed follows the markets & this particular time highlights that contention. The last time the Fed changed its interest rate was in July 2023, the last of 11 raises over a year and a half from March 2022 until July 2023. We believe the Fed follows a combination of the yields of the 3 and the 6 month U.S. T-bills. Since July 2023 the 6 month Bill fell from 5.48% to 4.61% or by 87 basis points; the 3 month Bill fell from 5.40% down to 4.89% or by 51 basis points. Note: that most of those drops happened over the past two months; still, the Fed has waited longer than usual to follow the market yields downward. We have read that market consensus is a 25 basis point cut; however, we think the Fed could easily cut it 50 basis points as that would be within the drops in market yields of both the 6 month and 3 month T-bills.

Sometimes the other markets like equties move in conjunction with the Fed moving its interest rate, but it seems to us that significant market moves only happen if the Fed does not match the market (which we think this time would be a cut of 50 basis points, per above). We think if they only cut by 25 basis points or if they cut by 75 basis points, we could see some noticeable movement in prices in other markets – only 25 bp, then probably a drop in prices; 75 bp, maybe a rally. Of course, we will see.

8-20-2024 – Equities – Since our last report there was a shocking decline in the equity indices; for example, the NASDAQ was down 12%! However, we have had large price rebounds since. We believe we are having yet another set of “market divergences” which, to us, are typical at tops – This being a HUGE TOP, these divergences have been spread out over years! Currently, it looks to us that the Dow Jones Industrials and the S&P500 could put in new All-time highs – they are very close. However, the divergence this time would be that the NASDAQ does not and that is the way it looks to us currently. As for (most of) the rest of the equity indices, they are still fairly far below their all-time highs of four months to 2 years ago and we continue to think they are “done.” Of course, we will see.

Commodities – Gold put in yet another (slight) All-time new high again not followed by sliver. Industrial commodities like Copper continue to decline or chop sideways. So, we do not think we are in a general inflation like in the late 1970’s (likely limited by the dramatically larger amounts of debt outstanding now as compared to then). And, because we believe interest rates will resume their rise shortly, at least at the long end (resulting in the yield curve Un-inverting), and commodities (and every thing else) are currently heavily leveraged, we expect rising interest rates will push down prices of most asset categories.

8-20-2024 – Our Most Recent Tax-Free Performance & The Muni Market – The short term muni market had a huge rally with the Short Term Category Average increasing by 103 basis points. Our performance was slightly better than its previous 12 month period; we lagged as we were giving up upside potential to pick up current (tax-free) yield and extra downside protection. However, even with the huge outperformance for the current month, the category averages, for the longer periods, did not improve all that much. Thus, our longer term actual, and especially relative, performance is still outstanding, per the table, below.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 7-31-2024

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 4.53% | 3.42% | 5.27% | 4.45% |

| 3 Years | 0.88% | 2.41% | 3.70% | 0.38% |

| 5 Years | 1.19% | 2.20% | 3.38% | 1.05% |

| 10 Years | 1.22% | 2.13% | 3.28% | 1.32% |

| 15 Years | 1.48% | 2.21% | 3.40% | 1.61% |

| Since Inception (1/1/1995) | N/A | 3.64% | 5.61% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

__________________________________________________

7-18-2024 – Our Most Recent Tax-Free Performance & The Muni Market – The short term muni market had a pretty good performance for the month of June 2024; we did too but, lagged slightly. Still, we are ahead of the Category Average for the current twelve months & substantially ahead for all longer periods because we did much better during the tougher months over the years!

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 6-30-2024

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 3.19% | 3.36% | 5.17% | 2.62% |

| 3 Years | 0.58% | 2.31% | 3.56% | 0.01% |

| 5 Years | 1.08% | 2.19% | 3.38% | 0.91% |

| 10 Years | 1.09% | 2.12% | 3.26% | 1.18% |

| 15 Years | 1.46% | 2.23% | 3.43% | 1.59% |

| Since Inception (1/1/1995) | N/A | 3.64% | 5.61% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

7-17-2024 – Equities – We are seeing some interesting Large divergences in the equities. We did not expect that the Dow Jones Industrial average would put in new All-Time Highs. We did previously highlight how it had diverged against the S&P 500 and the NASDAQ in not following along with them to new All-time highs. However, now The Industrial Average has BUT, as it was, the NASDAQ was dropping about 5% which is a fairly large move. Divergences like these happen at Top Turning Points, so that may be what is happening. Also, note that most of the other indices’ All-Time highs are still six months to two years ago – so those divergences are still intact.

Commodities – Commodities are also interesting with Gold putting in its own All-time high, but silver is not even close and the industrial commodities like oil and copper are trending downwards from prior highs. Thus, at this point we are not expecting a new wave of inflation.

Real Estate – We note a lot of homes that were purchased with almost zero percent interest rate financing from Adjustable loans are starting to reset much higher yields. These loans typically have “lock out periods” of so many years and limitations oh how much the interest rate they are charged can rise and when. After a period of time, those higher rates will be reflected in their monthly mortgage bill. This could be happening right now and could be the reason that retail has begun to falter as those borrowers are likely being a lot more careful with how they are spending their money since more is going to their mortgage interest. If interest rates continue to rise and/or adjustable rate yields continue to reset upwards, normally, prices of real estate drop (even though we have not see that with the large rise in interest rates over the past three years – which is highly unusual, at least during most of the last 50 years).

6-20-2024 – Equities – The current forecast model of what is going on in the equity markets is still intact – thus, so is our Super All Everything Double Top. As forecast, those few equity indices that have been putting in new highs are again putting in new highs – that is the NASDAQ and the S&P 500 – basically those that have an overweight in Nivida and Apple, and a few other stocks. Importantly, market tops very often see such concentrated positive performance as we have been seeing. Also important, the Dow Jones Industrials have dropped out of putting in new highs and, at least for now, have joined all the other equity indices we mentioned previously that are not putting in new highs. In that regards, most notably, we are following the Russell 2000 and the Dow Jones Transports (among others listed previously).

Commodities – We continue to monitor the divergences in the performance of various commodities with Gold putting in record highs, pretty much all by itself. Silver is still lower. Industrial commodities oil and copper are also not near new highs. Thus, as we’ve talked about before, because of these divergences we do not believe we are in a raging inflation like the 1970’s where all commodities were going up and up and up…Before they crashed down in to the early 1980’s.

So, commodities are kind of in the same kind of situation as the equities with major divergences and some Record Highs – the market tops of the equities and the commodities are spread out over years which is normal for market tops – the bigger the spread, the bigger the top & this top is huge.

Bonds & Interest Rates – We think bonds and interest rates are likely the lynch pin that, when pulled in the form of higher interest rates (lower bond prices), will bring the entire over-leveraged structure down. Of course, we have been saying this for a while and the yield on the U.S. T-bill has risen from almost zero to over 5% over the past two years and asset prices have not plummeted…..yet, but we believe any more increases in interest rates will likely break the dam, unfortunately. Of course, we will see and don’t bet the ranch.

6-18-2024 – Our Most Recent Tax-Free Performance & The Muni Market – The short term muni market had a slightly negative May 2024 but, for the current twelve months, a much worse month dropped off, which gave a nice rise in their total returns for the current twelve months. However, because of the current month drop, all other time periods of the averages saw declines in their total returns. On the other hand, were fortunate to have fairly large positive performance for the current month keeping us from lagging since the performance of the month that we dropped (for the current twelve months) was not as negative as were the averages. The result is that we did very well for the current twelve months and also increased our total returns for all longer periods, and, important since we are trying to maximize risk-adjusted performance, we did it with less volatility!

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 5-31-2024

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 3.03% | 3.31% | 5.10% | 2.44% |

| 3 Years | 0.36% | 2.25% | 3.45% | -0.23% |

| 5 Years | 0.97% | 2.16% | 3.32% | 0.84% |

| 10 Years | 1.02% | 2.09% | 3.22% | 1.11% |

| 15 Years | 1.40% | 2.22% | 3.41% | 1.56% |

| Since Inception (1/1/1995) | N/A | 3.64% | 5.60% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

5-16-2024 – Equities – So far so good for our current forecast, below, that those equity indices that had put in new All-Time Highs (over the past few years) would do so again, but those that did not, would not. And, that is what has happened. For example, both The S&P 500 and the Dow Jones Industrial Averages just put in new All-Time highs but the Russell 2000 (RUT) is still 9.3% below its 6-1-2021 All-Time High. This type of divergence is normal at “market tops” where the tops of various categories are spread out over time – the more spread out, likely the larger the top – and this one is currently very spread out. We don’t think the current rally is over but we think most equity indices that are not putting in new All-Time Highs right now will not quite make it by the time the whole thing turns down – “The Top Is In.” Of course, we will see.

5-16-2024 – Our Most Recent Tax-Free Performance & The Muni Market – The return for the Short Term Category average was down about 20 basis points while the index was down about 38 basis points; however, because of the performances of the month that dropped off, the Category down only slightly for the current twelve months while the Index was up 16 basis points. Unfortunately, their negative current month returns brought down their long term average returns. We had a good month and improved by 11 basis points for the current twelve months and, also, improved just slightly or stayed even for all but one of the longer term periods.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 4-30-2024

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 2.67% | 3.17% | 4.88% | 1.90% |

| 3 Years | 0.37% | 2.17% | 3.34% | -0.23% |

| 5 Years | 1.08% | 2.14% | 3.30% | 0.99% |

| 10 Years | 1.05% | 2.07% | 3.18% | 1.14% |

| 15 Years | 1.44% | 2.20% | 3.39% | 1.57% |

| Since Inception (1/1/1995) | N/A | 3.64% | 5.60% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

4-17-2024 – A Whiff of Inflation and interest rates go up (bonds down) and stocks slump – That is what we speculated was going on (previously) & interest rates have continued to break up from the short-intermediate term on out, and most equity indicies have been putting in lower lows, so much so (with a lot more information and analysis than that) that we believe “The Second Top” is likely “In” at least for the vast majority of stock indices. For example, the Russel 2000 (proxy “RUT”) is down about 8%; the Dow Jones Industrial Average is down about 5%. Still holding, as we pointed out below, only certain indicies have put in “new all-time highs” for their “Second Tops;” – most have not and we did not and do not expect them to. In fact, we think that, for those that have not, their second tops are in; for those that did, we think they likely could go higher. We think the most likely case is that, of those that did put in new All-time highs, only a couple might put in new ones – not the rest. In other words, we believe the Second Tops are likely in for the majority of the equity market. Confirmation would come with a new significant drop.

As for commodities, Silver did join Gold in putting in new All-time highs but most industrial commodities have not. Given our current Acting Model that any whiffs of inflation will continue to push interest rates up (bond prices down) giving headwinds to all asset prices, including not only industrial commodities but also financial commodities like gold and silver. Still, we would not bet the ranch on this – it seems easier to predict the bond market (interest rates) and stock prices. Of course, rising interest rates would also push real estate, which is hugely overvalued, down in price. The iShares U.S. Real Estate ETF (“IYR) is down almost 30% from its All-Time High on 12-1-2021. Hence, we believe the residential real estate market has a lot of catching up to do. Up to this point, we believe significant other factors have held it up – will they continue? that is the question.

4-17-2024 – Our Most Recent Tax-Free Performance & The Muni Market – The return for the Short Term Category average was essentially zero for the month and the month that dropped off for the current twelve months was pretty good, so the Category Average total return dropped a bit. The Short Index got hit worse. However, we actually had a bit of a positive total return for the current month resulting in a rise in our current 12 month return. Of course, the one year performances are not nearly as important as the longer terms and that is where we shine in the chart below:

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 3-31-2024

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 2.66% | 3.06% | 4.70% | 1.74% |

| 3 Years | 0.47% | 2.14% | 3.30% | -0.05% |

| 5 Years | 1.13% | 2.15% | 3.31% | 1.06% |

| 10 Years | 1.10% | 2.06% | 3.17% | 1.20% |

| 15 Years | 1.50% | 2.23% | 3.43% | 1.61% |

| Since Inception (1/1/1995) | N/A | 3.64% | 5.60% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

4-2-2024 – Interest Rates & Stocks & Commodities Update – Based on a ZeroHedge article today, “Market Now More Hawkish Than The Fed As June Rate-Cut Odds Fade” forecasts for 2024 by 13 broker/dealer economists is from 75 basis points to 125 basis points. In fact, based on the futures market, “…the market is now pricing in just 65bps of rate-cuts in 2024 (remember in January it was pricing in almost 170bps of cuts).” However, we post the following graph from 2016 through 3-15-2024 showing (if you look very closely) that the Fed Funds rates lags the combination of the U.S. 3 month and 6 month T-Bill yields:

Importantly, on 3-15-2024 both the 3 & 6 month U.S. T-bill yields were above the Fed Funds rate, making it, to us, unlikely that a cut will be made, at least in April [and quite possibly the rest of the year per inflation fears per the next paragraph].

In conjunction with that information and based on the rise of gold to new highs, we posited to an acquaintance on 4-2-2024:

“I guess the treasury market traded off a bit….it seems to me when gold hit

a new high…bonds traded off, interest rates up…Looks like the Ten Year and 30 Year yields are breaking up….Reminds me of the late 1970’s – so they’d been pumping the money supply and creating this inflation for several years [in the 1970’s]….until, it started causing interest rates to go up…then they had to stop printing money….This time [now], much earlier in the cycle (not nearly as much inflation) because the debt levels are enormously larger, I suppose. Of course, We will see.”

Importantly, interest rates went up and up and up after that time.

Thus, we believe the cycle of easing/increasing the money supply by credit and/or fiat inflation could very well be over because gold has put in new highs – it looks to us like “the brakes have been put on.” The evidence is that the yields on the 10 year and the 30 year have broken up (although only slightly at this juncture). If we are correct, we expect the prices of assets like stocks to start to tumble as the prices of real estate did from 1979 down into the 1982-1985 bottoms. Of course, we will see.

One may ask, “How do you know it isn’t a general inflation like the 1970’s?” Our answer is that, of course, we don’t for sure, but in the 1970’s all commodity prices were hitting new highs; however, right now, it is only gold, not oil, not silver, etc. Still, that one special commodity is enough to stop fiat/credit inflation policies, especially with short term rates fairly high and not falling so far. However, if other commodities join in, that could change our outlook. Another part of our answer is that the 1970’s inflation was mostly fiat (more dollars) but the current Super Bubble, until recently, is mostly credit (borrowing and lending) – At a certain point, more credit cannot be issued, and, fiat inflation (including debt bailout/forgiveness) more directly turns into rising commodity prices – it seems to us, that we are at that point and if the bubble isn’t inflating it is deflating, unfortunately.

3-18-2024 – Our Most Recent Tax-Free Performance – What happened last month in the short term municipal bond market reversed for the current 12 months, as a very bad month dropped off and the latest month came in relatively strong. The result is a very big rebound in the total return of the Category Average and the Category Index of about 100 basis points. Our rebound for the current 12 months was 21 basis points, but we never dropped as much. To us, the “proof” is in the Three Year total returns! You can see we have done very well.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 2-29-2024

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 3.73% | 3.27% | 5.03% | 3.55% |

| 3 Years | 0.54% | 2.08% | 3.20% | 0.12% |

| 5 Years | 1.21% | 2.16% | 3.32% | 1.19% |

| 10 Years | 1.07% | 2.05% | 3.15% | 1.19% |

| 15 Years | 1.52% | 2.23% | 3.43% | 1.67% |

| Since Inception (1/1/1995) | N/A | 3.64% | 5.61% | N/A |

Note: Indices do not have fees (trading costs, custody fees, management fees, etc.) deducted from their returns. We now have a much more reasonable index to compare to – the Bloomberg Barclay’s 3 Year Tax-Free Municipal Index. We still aim for similar or better returns with less risk – The key with this table is that our longer term pre-tax municipal bond returns are noticeably higher than the bond market index but with What We Think is less risk – we will see when rates start to rise and/or credit quality yield spreads widen.

Please see the Disclaimer and Footnotes at the bottom of the page for more information.

* at 35% Federal tax rate

2-18-2024 – Our Most Recent Tax-Free Performance – Wow, after its best month last month, the short term municipal market’s one year (12 month) return dropped about 100 basis points, as a great month dropped off the front of the period. Our performance also dropped for the current period but not anywhere near as much – only slightly; and now, we are leading the average again for the current 12 months and, importantly, with much less volatility (“measured risk”). The three year return shows our largest relative lead but the other years look good too.

Stamper Capital & Investments, Inc.

Separately Managed Accounts (National Tax-Free) vs. Tax-Free Municipal Bond Indices

Annual Total Returns, Period Ended 1-31-2024

| PERIOD | Morningstar Muni Short Category Average | SCI Separately Managed Tax-Fee Municipal Accounts Composite Net of Fees | SCI Separately Managed Accounts Net Pre-Tax Equivalent* | Bloomberg Barclay’s 3 Year Tax-Free Muni Bond Index |

|---|---|---|---|---|

| 1 Year | 2.60% | 3.06% | 4.71% | 1.83% |

| 3 Years | 0.31% | 2.05% | 3.16% | -0.03% |

| 5 Years | 1.23% | 2.14% | 3.30% | 1.23% |