“W”hat the Economy Might Look Like(Originally written by B. Clark Stamper June 12, 2002 and published in the 2nd Quarter 2002 edition of the newsletter, ‘The Wealth Preserver’)

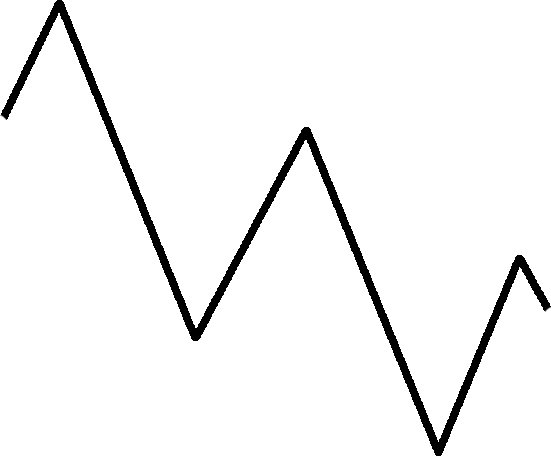

As forecast, the feeble rebound of the U.S. economy since its bottom in late September 2001 has begun to wane – you will probably agree that you no longer hear the “R” word bandied about like it was even a month ago – in this case the “R” word is “recovery.” Unfortunately, we believe the other “R” word, “recession,” will start to be heard again and in the end, quite possibly the “D” word (see our previous newsletters and our website www.riskadjusted.com). Although barely covered in the media, we note that the Business Cycle Dating Committee of the National Bureau of Economic Research (NBER) did not declare the economy to be in a “recovery,” and that it has taken issue with the widely held notion that the recession has been unusually brief and mild. The Dow Jones Industrial Average (DJIA) is down about 10% since the mid-March 2002 rebound peak and the NASDAQ has dropped about 25%. Importantly, the movement of stock prices has historically been the best indicator of the future direction of the economy out of the ten components of Conference Board’s U.S. Index of Leading Economic Indicators (LEI). In fact, the stock market is a better indicator of the direction of the U.S. economy than the LEI itself (of which it is a component, as mentioned above). The U.S. index of Leading Economic Indicators (LEI) fell during April, the first drop in seven months (but rose for in May). The recent stock market drop (along with the analysis in our previous reports) leads us to continue to believe that the recession is going to be much tougher than most in the press have forecast…so far.

Thus, we believe that the down leg of the right side of the “W” began in March of this year. The main point of this discussion is that the slight economic rebound that took place from September 2001 to now was not a “recovery” but simply a “breather” in a much larger downtrend in economic activity. Accordingly, we are still recommending investor’s brace for the worst, which we expect to begin shortly.

---------------------------------------------------------------------------------------- Stamper Capital & Investments, Inc. provides portfolio management services exclusively for institutional and high net worth accounts and does does not sell the mutual funds for which it is a sub-adviser. Also, please note: purchasers of mutual funds must receive a copy of a particular mutual fund's prospectus before a purchase is made. Stamper Capital & Investments, Inc. has been the sub-adviser to this Fund since October 1995 and B. Clark Stamper, our President, has been its Portfolio Manager since June 1990. Past performance does not guarantee future results, and current performance may be higher or lower than the performance data quoted. Investment return and principal value of an investment will fluctuate so that investor's shares, when redeemed, may be worth more or less than their original cost. Returns - Figures quoted are total returns calculated for the share class and time periods shown. Performance includes the reinvestment of income dividends and capital gains distributions. Performance does not reflect the deduction of taxes that a shareholder would pay on a fund distribution or the redemption of fund shares. Please go to Morningstar's and/or Lipper's websites for more information. Please see the our Disclaimer link on the bottom left of this page for more information about risk and return.

|

At

this time, we believe the shape could be a “W” – with the bottom of the

left side of the “W” being around September 2001 and with March 2002 being

the middle peak of the “W”.

At

this time, we believe the shape could be a “W” – with the bottom of the

left side of the “W” being around September 2001 and with March 2002 being

the middle peak of the “W”.